Question: Use the information and assumptions from Problem P 11-9 for this problem. The accompanying financial statements are for Paw and Sun Corporations, one year after

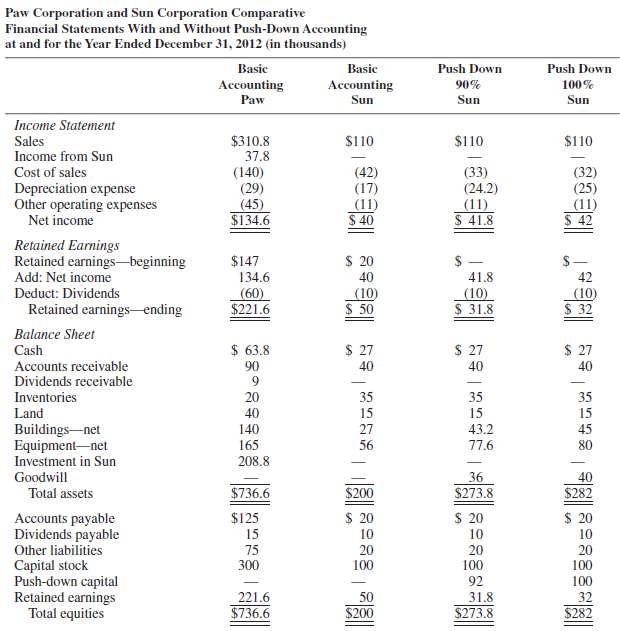

Use the information and assumptions from Problem P 11-9 for this problem. The accompanying financial statements are for Paw and Sun Corporations, one year after the acquisition. Note that Sun's statements are presented first under contemporary theory with no push-down accounting, then under 90 percent push-down accounting, and finally, under 100 percent push-down accounting.

Sun mailed a check to Paw on December 31, 2012, to settle an account payable of $8,000. Paw received the check in 2013. The $8,000 amount is included in Paw's December 31, 2012, accounts receivable.

REQUIRED: Prepare consolidation workpapers for Paw Corporation and Subsidiary for the year ended December 31, 2012, under(a) 90 percent push-down accounting and(b) 100 percent push-downaccounting.

Paw Corporation and Sun Corporation Comparative Financial Statements With and Without Push-Down Accounting at and for the Year Ended December 31, 2012 (in thousands) Basic Basic Push Down Push Down Accounting Sun 90% Accounting Paw 100% Sun Sun Income Statement $110 $310.8 37.8 Sales Income from Sun $110 $110 (32) (25) (11) 42 (42) (17) (11) $ 40 Cost of sales (140) (29) (45) $134.6 (33) (24.2) Depreciation expense Other operating expenses (11) $ 41.8 Net income Retained Earnings $ 20 Retained earnings- beginning Add: Net income $147 134.6 40 41.8 42 (60) $221.6 Deduct: Dividends (10) $ 50 (10) $ 31.8 (10) $ 32 Retained earnings-ending Balance Sheet $ 63.8 $ 27 $ 27 $ 27 Cash Accounts receivable Dividends receivable Inventories Land 90 40 40 40 35 35 35 40 15 15 15 Buildings-net Equipment-net Investment in Sun 140 27 43.2 45 77.6 165 56 80 208.8 Goodwill 36 40 $200 $282 Total assets $736.6 $273.8 $ 20 $ 20 $ 20 Accounts payable Dividends payable $125 15 10 10 10 Other liabilities 75 300 20 100 20 100 20 100 Capital stock Push-down capital Retained earnings Total equities 92 100 31.8 221.6 50 32 $736.6 $200 $282 $273.8 %24

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

a Paw Corporation and Subsidiary Consolidation Working Papers For the year ended December 31 2012 Push down 90 X parent company theory Power 90 Sun Ad... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-C (108).docx

120 KBs Word File