Question: Using Table 6-13, what is required new financing if next years sales forecast increases to $400,000, profit margin is 10 percent, and the payout ratio

Using Table 6-13, what is required new financing if next years sales forecast increases to $400,000, profit margin is 10 percent, and the payout ratio is 90 percent?

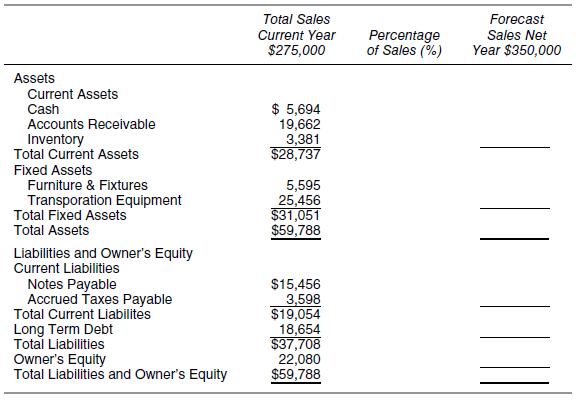

Table 6-13

Total Sales Forecast Current Year $275,000 Percentage of Sales (%) Sales Net Year $350,000 Assets Current Assets Cash Accounts Receivable $ 5,694 19,662 3,381 $28,737 Inventory Total Current Assets Fixed Assets Furniture & Fixtures 5,595 25,456 $31,051 $59,788 Transporation Equipment Total Fixed Assets Total Assets Liabilities and Owner's Equity Current Liabilities Notes Payable Accrued Taxes Payable Total Current Liabilites Long Term Debt Total Liabilities Owner's Equity Total Liabilities and Owner's Equity $15,456 3,598 $19,054 18,654 $37,708 22,080 $59,788

Step by Step Solution

3.28 Rating (166 Votes )

There are 3 Steps involved in it

If you solve with a calculator or Excel and dont round you will get 603636 In any ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

498-B-F-E (828).docx

120 KBs Word File