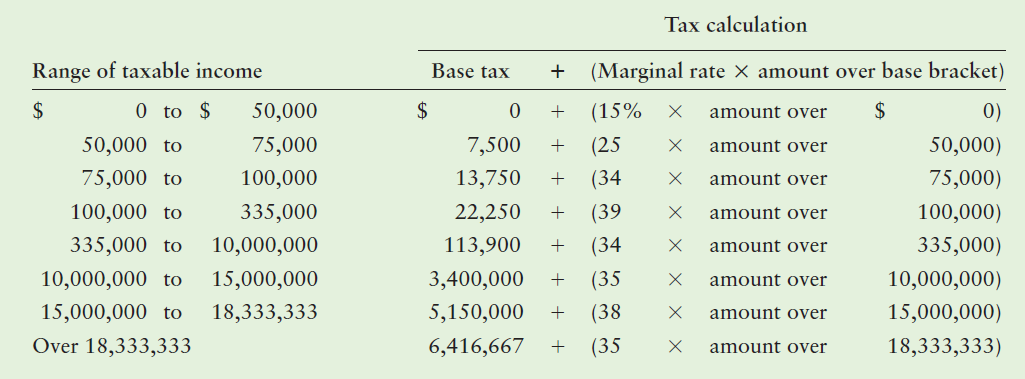

Question: Using the corporate tax rate schedule given in Table 2.1, perform the following: a. Find the marginal tax rate for the following levels of corporate

Using the corporate tax rate schedule given in Table 2.1, perform the following:

a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $15,000; $60,000; $90,000; $200,000; $400,000; $1 million; and $20 million.

b. Plot the marginal tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). Explain the relationship between these variables.

Table 2.1

Tax calculation Range of taxable income 0 to $ Base tax (Marginal rate X amount over base bracket) 0) amount over (15% (25 50,000 50,000) 75,000) 100,000) 335,000) 10,000,000) 15,000,000) amount over 50,000 to 75,000 7,500 75,000 to amount over 100,000 13,750 (34 amount over 100,000 to 335,000 22,250 (39 (34 amount over 335,000 to 10,000,000 113,900 amount over 10,000,000 to 15,000,000 3,400,000 (35 amount over 15,000,000 to 18,333,333 5,150,000 (38 Over 18,333,333 amount over 18,333,333) 6,416,667 (35

Step by Step Solution

3.38 Rating (173 Votes )

There are 3 Steps involved in it

a Tax Calculation Pretax Income Base Tax Amount over Base Total Tax Margi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

96-B-F-M-F (53).docx

120 KBs Word File