Question: Using the data provided in P22-5, prepare the statement of cash flows for The Khan Group using the direct method. Provide all required disclosures. In

Using the data provided in P22-5, prepare the statement of cash flows for The Khan Group using the direct method. Provide all required disclosures.

In P22-5

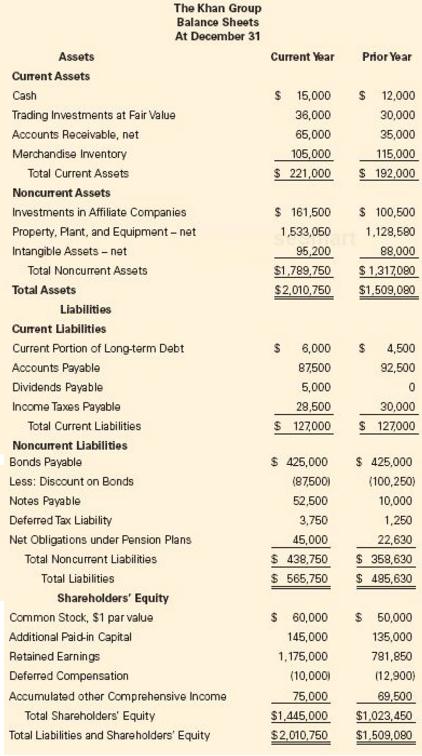

The Khan Group provided its balance sheet and income statement as of December 31 of the current year.

The Khan Group

Income Statement

For the Year Ended December 31

Current Year

Sales………………………………………………… $ 2,212,040

Cost of Goods Sold………………………………… 1,327,224

Gross Profit…………………………………………. $ 884,816

Selling, General, and Administrative Expenses…….. $ 43,000

Unrealized Losses…………………………………… $ 3,600

Pension Expense…………………………………….. 210,500

Bad Debt Expense…………………………………... 1,500

Depreciation Expense……………………………….. 17,700

Amortization Expense………………………………. 6,750

Total Operating Expenses…………………………… $ 283,050

Income before Interest and Taxes…………………… $ 601,766

Interest Expense…………………………………….. $ (50,100)

Investment Income (includes gain on sale)…………. 50,000

Equity Earnings from Affiliate Companies…………. 118,500

Income before Tax…………………………………... $ 720,166

Income Tax Expense………………………………… (288,066)

Net Income………………………………………….. $ 432,100

The Khan Group Balance Sheets At December 31 Assets Current Year Prior Year Current Assets S 15,000 12,000 30,000 35,000 105,000 115,000 S 221.000 S 192000 Trading Investments at Fair Value Accounts Receivable, net Merchandise Inventory 36,000 65,000 Total Current Assets Noncurrent Assets Investments in Affiliate Companies Property, Plant, and Equipment- net Intangible Assets-net S 161,500 100,500 1,533,050 1,128,580 88,000 $1.789,750 S 1,317090 $2,010,750 S1,509,080 Total Noncurrent Assets Total Assets Liabilities Current Liabilities Current Portion of Long-term Debt Accounts Payable Dividends Payable Income Taxes Payable S 6,000 4,500 92,500 87500 5,000 28,500 300 Total Current Liabilities Noncurrent Liabilities Bonds Payable Less: Disoount on Bonds Notes Payable Deferred Tax Liability Net Obligations under Pension Plans S 127000 127000 S 425,000 (87500 52,500 425,000 100,250 45,000 22,630 $ 438,750 358,630 S 565,750 485,630 Total Noncurrent Liabilities Total Liabilities Shareholders' Equity $ 60,000 50,000 135,000 781,850 (12,900) Accumulated other Comprehensive Income75,000 69,500 $1,445,000 $1,023,450 $2010 750 1.509.090 Cammon Stock, $1 parvalue Additional Paid-in Capital Retained Earnings Deferred Compensation 145,000 1.175,000 (10,000 Total Shareholders' Equity Total Liabilities and Shareholders' Equity

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

The first step in the solution is to isolate all balance sheet changes and ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1982).docx

120 KBs Word File