Question: Using the information pro-vided in P22-9, prepare the cash flow statement for Orlando Incorporated using the direct method. Provide all required disclosures In P22-9 Orlando

Using the information pro-vided in P22-9, prepare the cash flow statement for Orlando Incorporated using the direct method. Provide all required disclosures

In P22-9

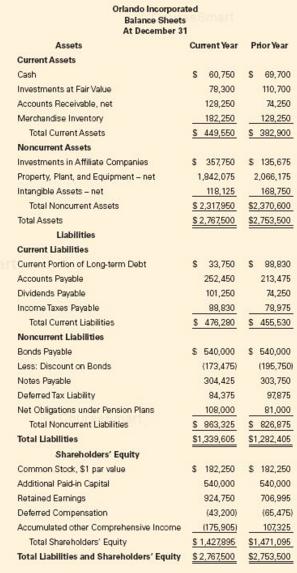

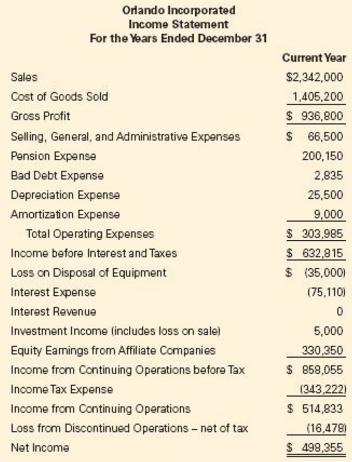

Orlando Incorporated pro-vided the following comparative balance sheets and the results of operations for the current year.

Orlando Incorporated Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Investments at Fair Value Accounts Receivable, net Marchandise Inventory s 60,750 69,700 7300 110,700 74,250 182 250 12250 S 449,650 S392,900 129,250 Total Current Assets Noncunent Assets Investments in Af ato Companies Property, Plant, and Equipment-net Intangble Assets-ot 357,750 135,675 42,075 2,066,175 118 125 169 7E0 S2.317950 $2370,600 Total Noncurrent Assets Total Assets 2.767500 $2.753.500 Liabilities Current Liabilities Current Portion of Long-torm Debt Accounts Payable Dividends Payable Income Taxes Payable s 33750 98.830 252,450 213,47 01,250 74,250 8883018.810 79,975 Total Curent Liablities Noncurent Liabilties Bonds Payable Loss: Discount on Bonds Notas Payable Deferred Tax Liablty Not Obigations under Pension Plans S 478.280 S 455.530 540000 540.000 173,475195,750 304425 303,750 4,375 97875 81,000 S 863325 S 826,875 $1,339,605 $1282,405 108,000 Total Noncurent Liabilities Total Liabilities Sharaholders Equity Comimon Stoc, $1 par value Additional Paid-in Capital Rotainod Earnings Deterred Compensation Accumulated othar Comprehensive Income (43,200 175,905 S 1,427996 Total Liabilities and Shareholders' Equity $2.267500 s 192,260 182,250 540,000 540,000 924,750706,99 (65,475) 107325 $1.471.095 $2753 500 Total Sharoholders' Equity Orlando Incorporated Income Statement For the ears Ended December 31 Sales Cost of Goods Sold Gross Proft Selling, General, and Administrative Expenses Pension Expense Bad Debt Expense Depreciation Expense Amortization Expense Current Year $2,342,000 1,405,200 S 936,800 S 66,500 200,150 2,835 25,500 9.000 Total Operating Expenses Income before Interest and Taxes Loss on Disposal of Equipment Interest Expense Interest Revenue Investment Income (includes loss on sale Equity Eamings from Affiliate Companies Income from Continuing Operations before Tax Income Tax Expense Income from Continuing Operations Loss from Discontinued Operations net of tax (16,478 Net Income $ 632,815 $ (35,000) (75,110) 5.000 330350 S 858,055 (343 222 514,833 $ 498.355

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balance Sheet Changes and Cash Flow Classification Asset... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1973).docx

120 KBs Word File