Using the information for Sarot, Inc., in SE 4, SE 5, and SE 7, compute the cash

Question:

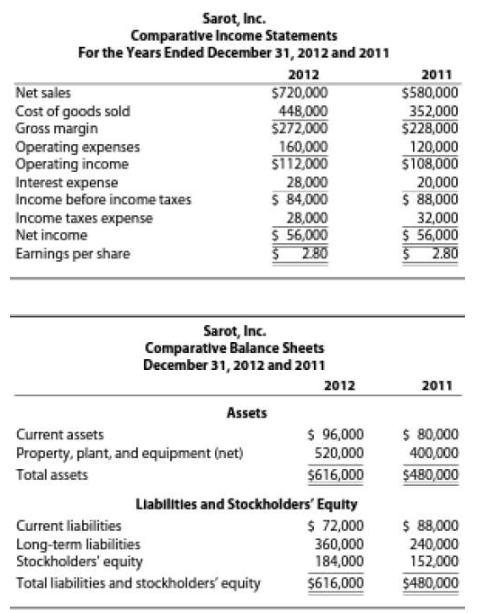

Using the information for Sarot, Inc., in SE 4, SE 5, and SE 7, compute the cash flow yield, cash flows to sales, cash flows to assets, and free cash flow for 2011 and 2012. Net cash flows from operating activities were $84,000 in 2011 and $64,000 in 2012. Net capital expenditures were $120,000 in 2011 and $160,000 in 2012. Cash dividends were $24,000 in both years. Comment on the results

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Transcribed Image Text:

Sarot, Inc. Comparative Income Statements For the Years Ended December 31, 2012 and 2011 Net sales Cost of goods sold Gross margin Operating expenses Operating income Interest expense Income before income taxes Income taxes expense Net income Earnings per share 2012 720,000 448,000 $272,000 160,000 $112,000 28,000 $ 84,000 28,000 S 56,000 2011 $580,000 352,000 $228,000 120,000 $108,000 20,000 $ 88,000 32,000 56,000 Sarot, Inc. Comparative Balance Sheets December 31, 2012 and 2011 2012 2011 Assets $96,000 520,000 Current assets Property, plant, and equipment (net) Total assets 80,000 400,000 $616,000 $480,000 Llabllitles and Stockholders' Equity Current liabilities Long-term liabilities Stockholders equity Total liabilities and stockholders' equity 72,000 88,000 240,000 152,000 $616,000 $480,000 360,000 184,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

Sarots cash flow adequacy has deteriorated from 2011 to 2012 The cash flow yield decl...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Question Posted:

Students also viewed these Managerial Accounting questions

-

Implement the following features of the SOS game: (1) the basic components for the game options (board size and game mode) and initial game, and (2) S/O placement for human players without checking...

-

Using the information for Obras, Inc., in SE 4 and SE 5, compute the debt to equity ratio and the interest coverage ratio for 20x8 and 20x9. Comment on the results. (Round computations to one decimal...

-

Net cash flows from operating activities were a. $12,000 b. $20,000 c. $24,000 d. $25,000 Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary Oakley Co....

-

Consider J symmetric firms operating in two periods with constant over time cost functions C j (x j , e j ) = (x j b j e j ) 2 /2b j , +c j x 2 j /2 The output prices are exogenous and given by p 1...

-

Several judicial doctrines limit basic tax planning strategies. What are they? Which planning strategies do they limit?

-

What uses would the seller have for these copies of the sales invoice?

-

Using the wine quality data from Table B.11, fit a model relating wine quality $y$ to flavor $x_{4}$ using region as an allocated code, taking on the values shown in the table $(1,2,3)$. Discuss the...

-

Select a company you are interested in and obtain its annual reports by going to the companys website. Download the annual report for the most recent year. (On many companies websites, you will need...

-

EM4.2 Expense Credit Card Required: Complete the following to record Internet services that Mookie The Beagle Concierge incurred. 1. Create an Expense paid with Credit Card. a. Select (+) New icon >...

-

How did Cecilia's interaction with the police make dealing with her schizophrenia harder?

-

Using the information for Sarot, Inc, in SE 4 and SE 5, compute the debt to equity ratio and the interest coverage ratio of 2011 and 2012. Comment on the results. Sarot, Inc. Comparative Income...

-

Using the information for Sarot, Inc., in SE 4, SE 5, and SE 9, compute the price/earnings (P/E) ratio and dividends yield for 2011 and 2012. The company had 20,000 shares of common stock outstanding...

-

Multiple Choice Questions 1. ABC Company uses the equity method to account for its 40% interest in the voting stock of XYZ Company. ABC paid $5,000,000 for the investment at the beginning of the...

-

We can test a claim about a population proportion using the P-value method of hypothesis testing or the critical value method of hypothesis testing, or we could base our conclusion on a confidence...

-

Shane Quadri contacted Don Hoffman, an employee of Al J. Hoffman & Co. (Hoffman Agency), to procure car insurance. Later, Quadris car was stolen. Quadri contacted Hoffman, who arranged with Budget...

-

Find the P-value in a test of the claim that the mean IQ score of acupuncturists is equal to 100, given that the test statistic is z = -2.00.

-

Chlorine (atomic number 17) is composed of two principal isotopes, chlorine-35, which has a mass of 34.9689 atomic mass units, and chlorine-37, which has a mass of 36.9659 atomic mass units. Assume...

-

In a recent Gallup poll of 511 adults, 64% said that they were in favor of the death penalty for a person convicted of murder. We want to use a 0.01 significance level to test the claim that the...

-

Review of key theoretical bases of learning and development

-

Find i 0 (t) for t > 0 in the circuit in Fig. 16.72 . 2 + Vo 1 7.5e-2t u(t) V ( +) 4.5[1 u(t)]V 0.5v. 1H

-

Calculate the force (in newtons) required to push a 40-kg wagon up a 10 incline (Figure 24). 10 40 kg

-

What would be a reason a company would want to understate income? A. To help nudge its stock price higher B. To lower its tax bill C. To show an increase in overall profits D. To increase investor...

-

Which of the following are found on the bank side of the bank reconciliation? A. NSF check B. Interest income C. Wire transfer into clients account D. Deposit in transit

-

Which of the following items are found on a book side of the bank reconciliation? A. Beginning bank balance B. Outstanding checks C. Interest income D. Error made by bank

-

The accounts of Grand Pool Service, Inc., follow with their normal balances at April 30, 2021. The accounts are listed in no particular order. (Click the icon to view the accounts.) Read the...

-

What kind of leader do you aspire to be and what are the traits? Explain.

-

10. Create the following row vector A where it has 18 elements (1 to 18). 1 4 7 10 13 16. 11 14 17 a. Use the reshape function to obtain B: == 2 5 8 3 6 9 12 15 18 b. Create a 7 element row vector...

Study smarter with the SolutionInn App