Question: V. S. Yogurt is considering two possible expansion plans. Proposal A involves opening 10 stores in northern California at a total cost of $3,150,000. Under

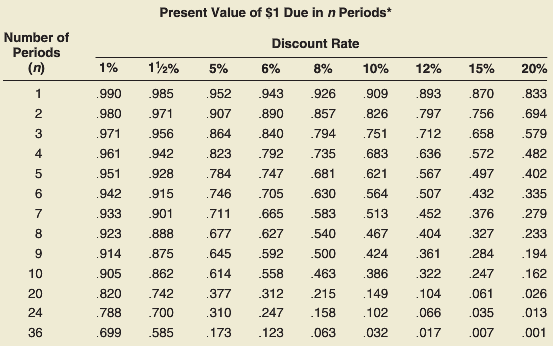

V. S. Yogurt is considering two possible expansion plans. Proposal A involves opening 10 stores in northern California at a total cost of $3,150,000. Under another strategy, Proposal B, V. S. Yogurt would focus on southern California and open six stores for a total cost of $2,500,000. Selected data regarding the two proposals have been assembled by the controller of V. S. Yogurt as follows:

-1.png)

Instructions

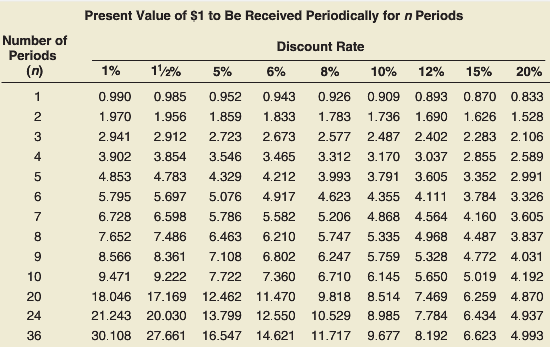

a. For each proposal, compute the (1) payback period, (2) return on average investment, and (3) net present value, discounted at management’s required rate of return of 15 percent. (Round the payback period to the nearest tenth of a year and the return on investment to the nearest tenth of a percent.) Use Exhibits 26–3 and 26–4 where necessary.

b. On the basis of your analysis in part a, state which proposal you would recommend and explain the reasoning behind your choice.

In Exhibits 26–3

In Exhibits 26–4

Proposal A Proposal B Required investment Estimated life of store locations. 7 years $400,000 570,000 450,000 300,000 .. . . . .. .. ...7 years Estimated annual net cash flow . . . .. . . . . . . . 750,000 Present Value of $1 Due in n Periods* Number of Periods Discount Rate 1% 1 % 5% 990 .985 980 971 971 956 961942 951.928 942 915 933 901 923 888 914 875 905 862 820742 788 700 699 6% 8% 10% 12% 15% 20% 952 943926 99 893 870 833 907 890 87 82797756 694 864840 794 751 712 658 579 823 792 735 683 636 572 482 784 74768 621 567 497 402 746 705 630 564 507 432 35 711 665 583 513 452376 279 677 627 540 47404327 233 645 592 500 424284 194 614 558 463 386 322 47162 377 312 215 49 104061 026 310 2478 102 066 035 013 173 123 063 032 017 007 001 2 3 4 6 7 10 20 24 36 585

Step by Step Solution

3.36 Rating (177 Votes )

There are 3 Steps involved in it

a Proposal A 1 Payback period 3150000 750000 42 years 2 Return on average investment 750000 450000 3... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

290-B-C-A-B (845).docx

120 KBs Word File