Question: Vasquez Corporation is considering investing in two different projects. It could invest in both, neither, or just one of the projects. The forecasts for the

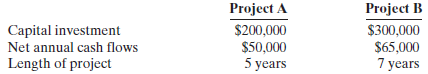

Vasquez Corporation is considering investing in two different projects. It could invest in both, neither, or just one of the projects. The forecasts for the projects are as follows.

The minimum rate of return acceptable to Vasquez is 10%.

Instructions

(a) Compute the net present value of the two projects.

(b) What capital budgeting decision should Vasquez make?

(c) Project A could be modified. By spending $20,000 more initially, the net annual cash flows could be increased by $10,000 per year. Would this change Vasquez’s decision?

Project B $300,000 Project A Capital investment Net annual cash flows Length of project $200,000 $50,000 5 years $65,000 7 years

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

a Project A 50000 X 379079 200000 10461 Project B 65000 X 486842 300000 16447 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-M-A-I-A (45).docx

120 KBs Word File