Question: You are the audit manager for Ken- Ron Enterprises. Your firm has been the entitys auditor for 15 years. Your firm normally uses a range

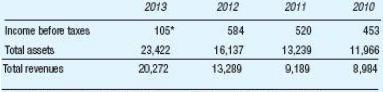

You are the audit manager for Ken- Ron Enterprises. Your firm has been the entity’s auditor for 15 years. Your firm normally uses a range of 3% to 5% of income before taxes to calculate overall materiality and 50– 75% of over-all materiality to calculate tolerable misstatement. Ken- Ron has reported the following financial statement data (in millions) for the last four years:

Required:

a. If you planned on using income before taxes as the benchmark to compute overall materiality and tolerable misstatement, how would you compute those amounts for 2013? Prepare and justify your calculations.

b. Determine overall materiality and tolerable misstatement using either total assets or total revenues as the benchmark. Make the calculations by utilizing both .25% and 2%, the endpoints of the range that your Firm’s guidance provides.

c. Assume that during the course of the 2013 audit you discovered misstatements totaling $ 50 million (approximately 50% of the 2013 income before taxes of $ 105 million). Discuss whether this amount of misstatement is material given your benchmark calculations from parts a. and b. above.

2013 105 23,422 2012 2011 Income before taxes Total assets Total revenues 2022 16137 520 13,289 2010 453 11,966 8,984 584 13,239 9,189

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

a Because of the significant drop in income in 2013 the auditor should use some time of normalized e... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

331-B-A-A-A-N (233).docx

120 KBs Word File