Question: You have completed a study and have found that you can save $7.5 million in the first year after closing two warehouses, opening a new

You have completed a study and have found that you can save $7.5 million in the first year after closing two warehouses, opening a new plant, and serving your customers from different facilities. This study was done with one year’s worth of data. The $7.5 million does not include the initial investment to close the warehouses and open the new plant. The initial investment is estimated to be $20 million. For the company you work for, you must include the net present value calculation when you present the business case. For the NPV calculations, your firm uses a 15% interest rate and goes out only five years (the thinking is that too much changes in five years, and they prefer shorter paybacks).

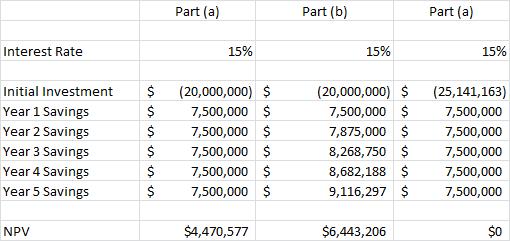

a. Calculate the NPV using the preceding data. Assume the same $7.5 million savings per year. Based on the NPV results, is this a good project?

b. The firm is growing fast. They would assume that the savings grow 5% per year. That is, if they implement this solution, the savings in Year 2 will be 5% higher than the $7.5 million because they will be shipping much more product two years out. What is the new NPV?

c. Being conservative and going back to the original assumptions, how large would the initial investment have to be for the NPV to equal $0 (zero)? How should the firm use this answer to decide whether they should implement this solution?

d. If you had included the full $20 million as a fixed cost in the model, why would the model not have recommended closing the two warehouses and opening the new plant?

Part (a) Part (b) Part (a) Interest Rate 15% 15% 15% $ (20,000,000) $ $ (20,000,000) $ 7,500,000 $ Initial Investment (25,141,163) 7,500,000 $ 7,500,000 $ Year 1 Savings 7,500,000 Year 2 Savings $ 7,875,000 $ 7,500,000 $ 7,500,000 $ 7,500,000 $ Year 3 Savings 8,268,750 $ 7,500,000 Year 4 Savings $ 8,682,188 $ 7,500,000 Year 5 Savings $ 7,500,000 $ 9,116,297 $ 7,500,000 NPV $4,470,577 $6,443,206 $0

Step by Step Solution

3.46 Rating (172 Votes )

There are 3 Steps involved in it

For a b and c I created a spreadsheet as shown below For NPV I use the Excel formula NPVra... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

619-B-M-L-S-C-M (3913).docx

120 KBs Word File