You have recently been hired by Keafer Manufacturing to work in its established treasury department. Keafer Manufacturing

Question:

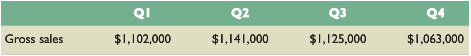

The company had the following sales each quarter of the year just ended:

After some research and discussions with customers, you€™re projecting that sales will be 8 percent higher in each quarter next year. Sales for the first quarter of the following year are also expected to grow at 8 percent. You calculate that Keafer currently has an accounts receivable period of 57 days and an accounts receivable balance of $675,000. However, 10 percent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely that this portion will never be collected.

You€™ve also calculated that Keafer typically orders supplies each quarter in the amount of 50 percent of the next quarter€™s projected gross sales, and suppliers are paid in 53 days on average. Wages, taxes, and other costs run about 25 percent of gross sales. The company has a quarterly interest payment of $185,000 on its long-term debt. Finally, the company uses a local bank for its short-term financial needs. It currently pays 1.2 percent per quarter on all short-term borrowing and maintains a money market account that pays .5 percent per quarter on all short-term deposits.

Adam has asked you to prepare a cash budget and short-term financial plan for the company under the current policies. He has also asked you to prepare additional plans based on changes in several inputs.

1. Use the numbers given to complete the cash budget and short-term financial plan.

2. Rework the cash budget and short-term financial plan assuming Keafer changes to a minimum cash balance of $90,000.

3. Rework the sales budget assuming an 11 percent growth rate in sales and a 5 percent growth rate in sales. Assume a $135,000 target cash balance.

4. Assuming the company maintains its target cash balance at $135,000, what sales growth rate would result in a zero need for short-term financing? To answer this question, you may need to set up a spreadsheet and use the €œSolver€ function.

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Corporate Finance

ISBN: 978-0077861759

10th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe