Question: Your firm is considering two projects: Project A and Project B with the following cash flows: a. Calculate the NPVs based on WACCs of 5%

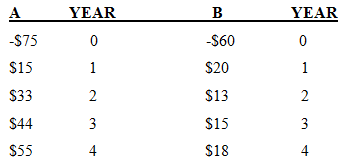

Your firm is considering two projects: Project A and Project B with the following cash flows:

a. Calculate the NPVs based on WACCs of 5% and 7%

b. What are the IRRs based on the WACCs?

c. Calculate the payback period and discounted payback period

d. Which projects should the firm accept if they are independent, based on the NPV, IRR, payback period, and discounted payback period methods? Assume your firm requires projects to break even in three years

E01234 00358 $2111 01234 A-75 1 3 4 5 $S$$

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Computation of the following a b c for separate for project A and project B Project A a Year Project ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

68-B-C-F-C-B (1248).docx

120 KBs Word File