A review of the ledger of Terrell Company at December 31, 2012, produces these data pertaining to

Question:

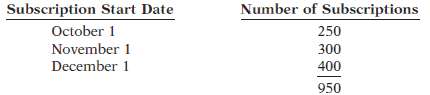

A review of the ledger of Terrell Company at December 31, 2012, produces these data pertaining to the preparation of annual adjusting entries.1. Prepaid Insurance $15,200. The company has separate insurance policies on its buildings and its motor vehicles. Policy B4564 on the building was purchased on July 1, 2011, for $9,600. The policy has a term of 3 years. Policy A2958 on the vehicles was purchased on January 1, 2012, for $7,200. This policy has a term of 18 months.2. Unearned Sales Revenue $22,800: The company began selling magazine subscriptions on October 1, 2012, on an annual basis. The selling price of a subscription is $24. A review of subscription contracts reveals the following.

3. Notes Payable, $40,000: This balance consists of a note for 6 months at an annual interest rate of 7%, dated October 1.4. Salaries Payable $0: There are eight salaried employees. Salaries are paid every Friday for the current week. Five employees receive a salary of $600 each per week, and three employees earn $700 each per week. Assume December 31 is a Wednesday. Employees do not work weekends. All employees worked the last 3 days of December.InstructionsPrepare the adjusting entries at December 31,2012.

Step by Step Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso