Question: A U.S. portfolio manager has a global equity portfolio with investments in the United States, United Kingdom, and France. The local currency values of the

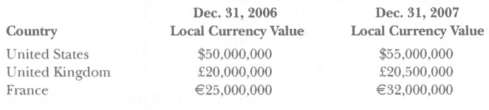

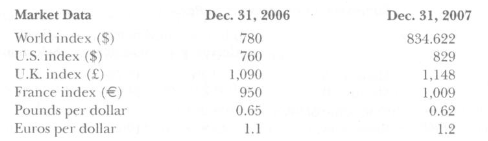

A U.S. portfolio manager has a global equity portfolio with investments in the United States, United Kingdom, and France. The local currency values of the equity investments on December 31, 2006, and December 31, 2007, are shown in the following table. The performance of the portfolio manager is measured against the World index, which has 60 percent weight in the U.S. stock index, a 20 percent weight in the U.K. stock index, and a 20 percent weight in the French stock index. Assume that no dividends were paid and there were no cash flows in the portfolio during the year. The base currency is the U.S. dollar. The country components of the portfolio have average risk relative to their respective country indexes. Use the information provided in the following tables to answer the questions asked.

a. Calculate the local currency return and dollar return on the portfolio for the period December 31, 2006, to December 31, 2007.

b. Decompose the total return on the portfolio into the following components:

– Capital gains in local currency

– Currency contribution

c. Decompose the total return on the portfolio into the following components:

– Market component

– Security selection contribution

– Currency component

d. Carry out a global performance evaluation for the portfolio relative to the World index. Make sure the global performance attribution identifies the following components:

– Benchmark return

– Market allocation

– Currency allocation

– Security selection

Dec. 31, 2006 Local Currency Value Dec. 31, 2007 Local Currency Value Country United States United Kingdom France $50,000,000 20,000,000 25,000,000 $55,000,000 20,500,000 32,000,000

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

a The local currency returns are shown in the following table Country Dec 31 2006 Dec 31 2007 Return United States 50000000 55000000 100 United Kingdom 20000000 20500000 25 France 25000000 32000000 28... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

850-B-A-I (8291).docx

120 KBs Word File