Question: After the model of problem 11-35, the next model was run: The regression equation is Analysis of Variance a. What happened when Price was dropped

After the model of problem 11-35, the next model was run:

The regression equation is

-1.png)

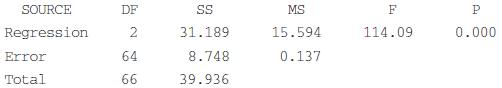

Analysis of Variance

a. What happened when Price was dropped from the regression equation? Why?

b. Compare this model with all previous models of exports versus the economic variables, and draw conclusions.

c. Which model is best overall? Why?

d. Conduct the F test for this particular model.

e. Compare the reported value of s in this model with the reported s value in the model of problem 11-35. Why is s higher in this model?

f. For the model in problem 11-35, what is the mean square error?

EXPORTS =-1.09 + 0.552 M1 + 0.171 LEND Predictor Constant M1 LEND S0.3697 Coef 1.0859 0.55222 0.17100 Stdev 0.3914 0.03950 0.02357 t-ratio 2.77 13.98 7.25 (adj ) 0.007 0.000 0.000 -77.4% R-sq SOURCE Regression 2 31.189 15.594 114.09 0.000 Error Total DF MS 64 8.748 0.137 66 39.936

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

a As Price is dropped Lend becomes significant there ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

463-M-S-L-R (2211).docx

120 KBs Word File