In our Nodhead example, true depreciation was decelerated. That is not always the case. For instance, figure

Question:

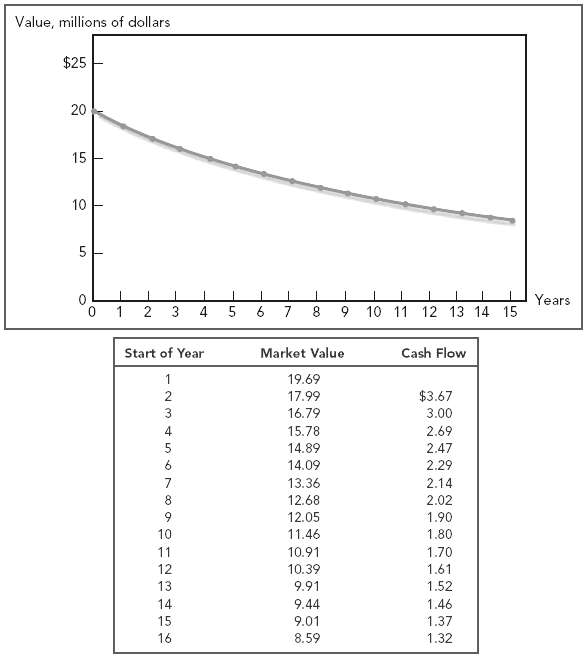

In our Nodhead example, true depreciation was decelerated. That is not always the case. For instance, figure shows how on average the value of a Boeing 737 has varied with its age.28 Table 12.11 shows the market value at different points in the plane?s life and the cash flow needed in each year to provide a 10 percent return. (For example, if you bought a 737 for $19.69 million at the start of year 1 and sold it a year later, your total profit would be 17.99 + 3.67 ? 19.69 = $1.97 million, 10 percent of the purchase cost.) Many airlines write off their aircraft straight-line over 15 years to a salvage value equal to 20 percent of the original cost.

a.?Calculate economic and book depreciation for each year of the plane?s life.

b.?Compare the true and book rates of return in each year.

c.?Suppose an airline invested in a fixed number of Boeing 737s each year. Would steady-state book return overstate or understate true return?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers