Question: Below is selected financial statement information for Verizon Communications Inc., taken from its 2010 annual report. Verizon's noncontrolling interest is comprised primarily of Vodafone's 45

Below is selected financial statement informa¬tion for Verizon Communications Inc., taken from its 2010 annual report. Verizon's noncontrolling interest is comprised primarily of Vodafone's 45 percent interest in Verizon Wireless, which Verizon consolidates due to its 55 percent controlling interest. All amounts are in millions, except per share amounts.

Income statement, year ended December 31, 2010:

Operating Revenues..................................................................................................................................................................... $106,565

Operating Expenses

Cost of services and sales (exclusive of items shown below)......................................... 44,149

Selling, general and administrative expense..................................................................... 31,366

Depreciation and amortization expense ............................................................................ 16,405

Total Operating Expenses ........................................................................................................................................................... 91,920

Operating Income ...................................................................................................................................................................... 14,645

Equity in earnings of unconsolidated businesses............................................................. 508

Other income and (expense), net ....................................................................................... 54

Interest expense .................................................................................................................... (2,523)

Income Before (Provision) Benefit for Income Taxes ................................................................................................................. 12,684

(Provision) benefit for income taxes ................................................................................. (2,467)

Net Income................................................................................................................................................................................ $ 10,217

Net income attributable to noncontrolling interest.......................................................................................................................... $7,668

Net income (loss) attributable to Verizon ..................................................................................................................................... 2,549

Net Income................................................................................................................................................................................... $ 10,217

Basic Earnings (Loss) Per Common Share

Net income (loss) attributable to Verizon ................................................................................. $ .90

Weighted-average shares outstanding (in millions)................................................................ 2,830

Diluted Earnings (Loss) Per Common Share

Net income (loss) attributable to Verizon ................................................................................. $ .90

Weighted-average shares outstanding (in millions)................................................................ 2,833

Excerpts from statement of changes in equity for 2010: Noncontrolling Interest

Balance at beginning of year..................................................................................................... $42,761

Net income attributable to noncontrolling interest................................................................. 7,668

Other comprehensive income (loss)......................................................................................... (35)

Total comprehensive income.................................................................................................... 7,633

Distributions and other............................................................................................................... (2,051)

Balance at end of year................................................................................................................ 48,343

Total Equity...................................................................................................................................................................................... $86,912

Comprehensive Income

Net income................................................................................................................................... $10,217

Other comprehensive income (loss)......................................................................................... 2,363

Total comprehensive income............................................................................................................................................................. 12,580

Comprehensive income attributable to noncontrolling interest............................................ 7,633

Comprehensive income (loss) attributable to Verizon........................................................... 4,947

Total comprehensive income............................................................................................................................................................. $12,580

Required

a. Assume the noncontrolling interest consists entirely of Vodafone's 45 percent interest in Verizon Wireless. What was Verizon Wireless' separate net income for 2010? What was Verizon Communications' separate net income for 2010?

b. The noncontrolling interest in other comprehensive income is a loss of $35. Total consolidated other comprehensive income is a gain of $2,363. Explain this result.

c. Prepare consolidation eliminating entry N for 2010, assuming "distributions and other" are cash dividends declared.

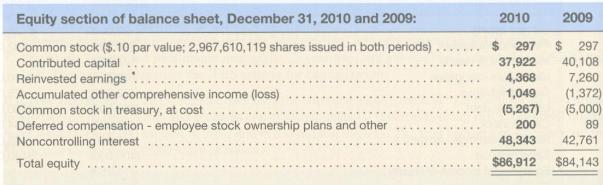

Equity section of balance sheet, December 31, 2010 and 2009: 2010 2009 Common stock ($.10 par value; 2,967,610,119 shares issued in both periods) ....297 297 Contributed capital.r*.* 37,922 40,108 Reinvested earnings . . Accumulated other comprehensive income (loss) -.. . . . . . . . . . . .. ,.. , , 1,049 (1,372) ...4,368 Deferred compensation employee stock ownership plans and other..... 200 89 Total equity..a..$86,912 $84,143

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

a V odafones 45 percent noncontrolling interest in net income is 7668 implying t... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

900-B-A-A-D (695).docx

120 KBs Word File