Question: Consider a $6500 piece of machinery, with a 5-year depreciable life and an estimated $1200 salvage value . The projected utilization of the machinery when

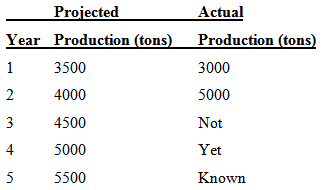

Consider a $6500 piece of machinery, with a 5-year depreciable life and an estimated $1200 salvage value. The projected utilization of the machinery when it was purchased, and its actual production to date are shown below.

Compute the machinery depreciation schedule by each of the following methods:

(a) Straight line.

(b) Sum-of-years' -digits.

(c) Double declining balance.

(d) Unit of production (for first 2 years only).

(e) Modified accelerated cost recovery system.

Projected Actual Year Production (tons) Production (tons) 3500 3000 1 4000 5000 4500 Not 4 5000 Yet 5500 Known

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

CCA rate30 Year Class No Undep capital cost at beginning of year Cost of acq d... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (318).docx

120 KBs Word File