Cure-all, Inc., has developed a drug that will diminish the effects of aging. Cure-all has spent $1,000,000

Question:

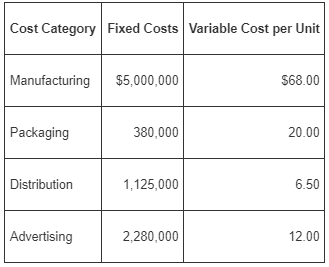

Cure-all, Inc., has developed a drug that will diminish the effects of aging. Cure-all has spent $1,000,000 on research and development and $2,108,000 for clinical trials. Once the drug is approved by the FDA, which is imminent, it will have a five-year sales life cycle. Laura Russell, Cure-all’s chief financial officer, must determine the best alternative for the company among three options. The company can choose to manufacture, package, and distribute the drug; outsource only the manufacturing; or sell the drug’s patent. Laura has compiled the following annual cost information for this drug if the company were to manufacture it:

Management anticipates a high demand for the drug and has benchmarked $235 per unit as a reasonable price based on other drugs that promise similar results. Management expects sales volume of 3,000,000 units over five years and uses a discount rate of 10 percent. If Cure-all chooses to outsource the manufacturing of the drug while continuing to package, distribute, and advertise it, the manufacturing costs would result in fixed costs of $1,500,000 and variable cost per unit of $80. For the sale of the patent, Cure-all would receive $300,000,000 now and $25,000,000 at the end of every year for the next five years.

Required

Determine the best option for Cure-all. Support your answer.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins