Question: DeVita Company, which has been operating for three years, provides marketing consulting services worldwide for dot-com companies. You are a financial analyst assigned to report

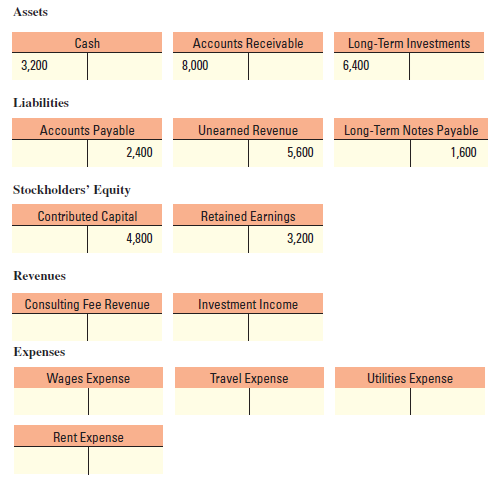

DeVita Company, which has been operating for three years, provides marketing consulting services worldwide for dot-com companies. You are a financial analyst assigned to report on the DeVita management team’s effectiveness at managing its assets efficiently. At the start of 2012 (its fourth year), DeVita’s T-account balances were as follows. Dollars are in thousands.

Required:

1. Using the data from these T-accounts, amounts for the following on January 1, 2012, were

Assets $_______ = Liabilities $_______ + Stockholders’ Equity $ _______.

2. Enter the following 2012 transactions in the T-accounts:

a. Received $5,600 cash from clients on account.

b. Provided $56,000 in services to clients who paid $48,000 in cash and owed the rest on account.

c. Received $400 in cash as income on investments.

d. Paid $16,000 in wages, $16,000 in travel, $9,600 rent, and $1,600 on accounts payable.

e. Received a utility bill for $800 for 2012 services.

f. Paid $480 in dividends to stockholders.

g. Received $1,600 in cash from clients in advance of services DeVita will provide next year.

3. Compute ending balances in the T-accounts to determine amounts for the following on December 31, 2012:

Revenues $_______ – Expenses $_______ = Net Income $ _______.

Assets $_______ = Liabilities $_______ + Stockholders’ Equity $ _______.

4. Calculate the total asset turnover ratio for 2012. If the company had an asset turnover ratio in 2011 of 2.00 and in 2010 of 1.80, what does your computation suggest to you about DeVita Company?

What would you say in your report?

Assets Cash Accounts Receivable Long-Term Investments 3,200 8,000 6,400 Liabilities Long-Term Notes Payable Accounts Payable Unearned Revenue 2,400 5,600 1,600 Stockholders' Equity Contributed Capital Retained Earnings 3,200 4,800 Revenues Consulting Fee Revenue Investment Income Expenses Utilities Expense Wages Expense Travel Expense Rent Expense

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Req 1 Req 2 Req 3 Req 4 17600 31920 2 The 400 of investment income is not an operat... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

143-B-A-I-S (734).docx

120 KBs Word File