Question: Electron, Inc. is a semiconductor company based in San Jose. In 2009, it produced a new router system for its corporate clients. The average wholesale

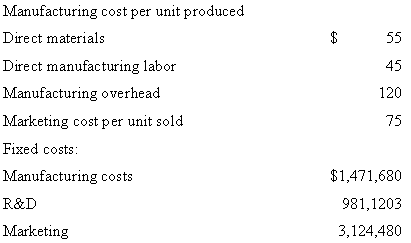

Electron, Inc. is a semiconductor company based in San Jose. In 2009, it produced a new router system for its corporate clients. The average wholesale selling price of the system is $1,200 each. For 2009, Electron estimates that it will sell 10,000 router systems and so produces 10,000 units. Actual 2009 sales are 8,960 units. Electron’s actual 2009 costs are:

1. Calculate the operating income under variable costing.

2. Each router unit produced is allocated $165 in fixed manufacturing costs. If the production-volume variance is written off to cost of goods sold, and there are no price, spending, or efficiency variances, calculate the operating income under absorption costing.

3. Explain the differences in operating incomes obtained in requirement 1 and requirement 2.

4. Electron’s management is considering implementing a bonus for the supervisors based on gross margin under absorption costing. What incentives will this create for the supervisors? Do you think this new bonus plan is a good idea? Explain briefly.

Manufacturing cost per unit produced Direct materials 55 Direct manufacturing labor 45 Manufacturing overhead 120 Marketing cost per unit sold 75 Fixed costs: Manufacturing costs $1,471,680 R&D 981,1203 Marketing 3,124,480

Step by Step Solution

3.28 Rating (177 Votes )

There are 3 Steps involved in it

1 The variable manufacturing cost per unit is 55 45 120 220 2 3 2009 operating income under absorption costing is greater than the operating income un... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-P-A (197).docx

120 KBs Word File