Question: Excerpts from the 2008 financial report of Inter, a computer-processor manufacturer, are as follows (dollars in millions). Review this information, calculate relevant ratios from figure,

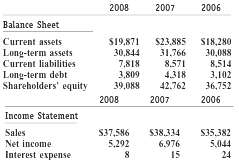

Excerpts from the 2008 financial report of Inter, a computer-processor manufacturer, are as follows (dollars in millions).

Review this information, calculate relevant ratios from figure, and explain why Intel appears to be a good or poor investment. The tax rate was 31 percent.

2008 2007 2006 Balance Sheet S19,871 Current assets Long-term assets Current liabilities Long-term debt Shareholders' equity S23,885 SI8,280 30,088 8,514 3,102 36,752 30,844 31.766 7,818 3,809 39,088 8.571 4.318 42.762 2008 2007 2006 Income Statement S35,382 5,044 24 Sales S37,586 5,292 538.334 Net income 6,976 Interest expense 15

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Profitability Ratios Return on Equity Net Income Average Stockholders Equity 2008 5... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-F-S (554).docx

120 KBs Word File