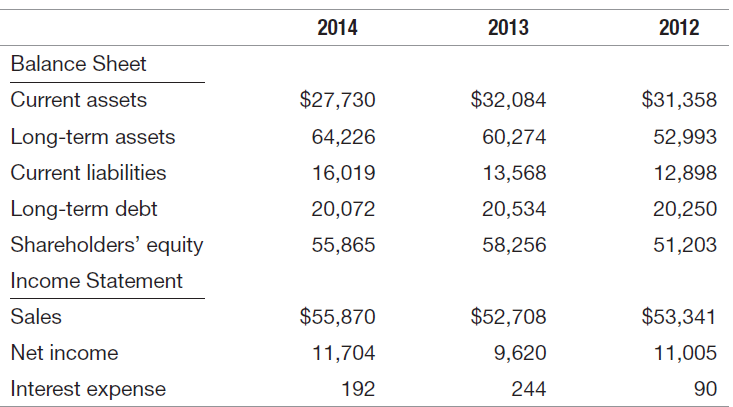

Question: Excerpts from the 2014 financial report of Intel, a computer-processor manufacturer, are as follows (dollars in millions). Review this information, calculate relevant ratios from Figure

Review this information, calculate relevant ratios from Figure 5€“5, and explain why Intel appears to be a good or poor investment. The tax rate was 25.9 percent.

Figure 5-5

2014 2013 2012 Balance Sheet $27,730 $32,084 $31,358 Current assets Long-term assets 64,226 60,274 52,993 Current liabilities 16,019 13,568 12,898 Long-term debt 20,072 20,534 20,250 Shareholders' equity 58,256 55,865 51,203 Income Statement $55,870 $52,708 $53,341 Sales Net income 11,005 11,704 9,620 Interest expense 192 244 90

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Profitability Ratios Return on Equity Net Income Average Shareholders Equity 201411704 58... View full answer

Get step-by-step solutions from verified subject matter experts