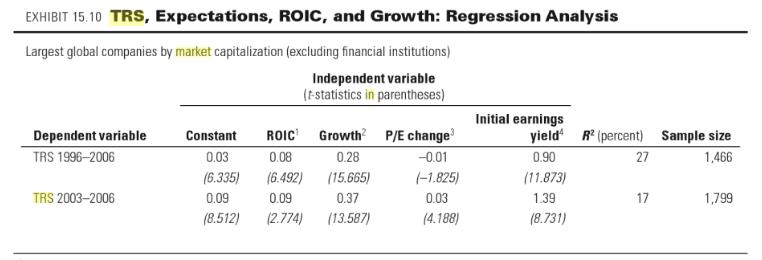

Fundamentals explain less of the variation in TRS than in market-valuet-o- book-value or market-value-to-earnings ratios (as measured

Question:

Transcribed Image Text:

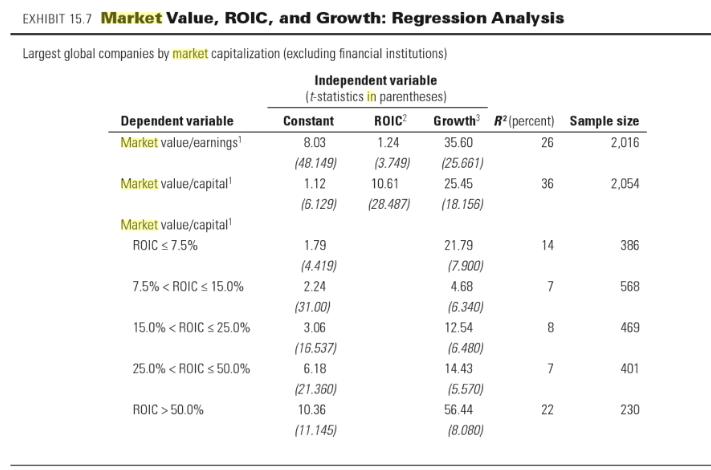

EXHIBIT 15.7 Market Value, ROIC, and Growth: Regression Analysis Largest global companies by market capitalization (excluding financial institutions) Independent variable (t-statistics in parentheses) Growth R (percent) Sample size 2,016 Dependent variable Constant ROIC? Market value/earnings 8.03 1.24 35.60 26 (48.149) (3.749) (25.661) Market value/capital' 1.12 10.61 25.45 36 2,054 (6.129) (28.487) (18.156) Market value/capital ROIC <7.5% 1.79 21.79 14 386 (4.419) (7.900) 7.5% < ROIC < 15.0% 2.24 4.68 568 (31.00) (6.340) 15.0% < ROIC s 25.0% 3.06 12.54 469 (16.537) (6.480) 25.0% < ROIC < 50.0% 6.18 14.43 7 401 (21.360) (5.570) ROIC > 50.0% 10.36 56.44 22 230 (11.145) (8.080) 7.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

TRS is driven by ROIC and growth and not by accounting me...View the full answer

Answered By

Amit Choudhary

I'm new in this profession regarding online teaching but previously i used to teach students near my college. I am teaching on online platform since last year and got good support from the students. I'm teaching on platforms like chegg and vedantu and also at my home in free time.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Valuation Measuring and managing the values of companies

ISBN: ?978-0470424704

5th edition

Authors: Mckinsey, Tim Koller, Marc Goedhart, David Wessel

Question Posted:

Students also viewed these Corporate Finance questions

-

What proportion of the variation in annual support cost can be explained by the relationship between floor space and support cost that your line describes? Benton University is planning to construct...

-

a. What fraction of the variation in salaries can be explained by the fact that some employees have more experience than others? b. What salary would you expect for an individual with eight years of...

-

a. What fraction of the variation in salaries can be explained by the fact that some employees are older than others? b. What salary would you expect for a 42-year-old individual? c. Find the 95%...

-

Oil flows through the 100-mm-diameter pipe with a velocity of 5 m/s. If the pressure in the pipe at A and B is 80 kpa, determine the x and y components of force the flow exerts on the elbow. The flow...

-

In Exercise 41, an error was made in grading your final exam. Instead of getting 93, you scored 85. What is your new weighted mean? In Exercise 41 Homework Quizzes Project Speech Final exam Score 85...

-

Explain the importance of 6 2 5 1 forms for taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

-

Using the gasoline mileage data in Table B. 3 find the eigenvectors associated with the smallest eigenvalues of \(\mathbf{X}^{\prime} \mathbf{X}\). Interpret the elements of these vectors. What can...

-

Timeline Manufacturing Co. is evaluating two projects. The company uses payback criteria of three years or less. Project A has a cost of $912,855, and project Bs cost is $1,175,000. Cash flows from...

-

Write a statement that assigns total_coins with the sum of nickel_count and dime_count. Sample output for 100 nickels and 200 dimes is: 300 Learn how our autograder works 542962 3875132.4x3zqy7 1...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Exhibit 15.1 shows how (cumulative) returns on investments in the equity market index have consistently exceeded returns on investments in government bonds over the past 200 years. This being the...

-

Many corporate executives focus on earnings per share (EPS) and attempt to manage reported earnings in order to meet analysts expectations. Can managers succeed in protecting the stock price of their...

-

Lisi, vice president of the National Football Association, made arrangements to hold the associations annual convention at the Marvel Hotel and Convention Center. He met with Brock, the hotel...

-

Kyler was assumed to be female at birth. However, at the age of ten Kyler began exhibiting signs that he was a boy. At the age of twelve, due to increasing gender dysphoria, Kyler began engaging in...

-

The following information has been extracted from the accounting records of entity I: Determine the amount of financing cash flows entity I would report in its statement of cash flows for the year...

-

Entities A, B and C have 60 per cent, 30 per cent and 10 per cent equity interests in entity D. Entity D has 10 board members, six from entity A, three from entity B and one from entity C. Each board...

-

Identify the major steps in the audit process.

-

An entity issued a five-year bond that is listed and traded on a stock exchange. In the following year, the entity proposes a modification of the bonds repayment terms, to extend the maturity. The...

-

The aqueous solution pK a values for HOCN, H 2 NCN, and CH 3 CN are approximately 4, 10.5, and 20 (estimated), respectively. Explain the trend in these cyano derivatives of binary acids and compare...

-

Classify each of the following as direct costs or indirect costs of operating the Pediatrics ward for children at the Cleveland Clinic: a. Wi-Fi covering the entire hospital campus b. Net cost of...

-

Does the retained earnings figure on a companys balance sheet indicate the amount of funds the company has available for current dividends or capital expenditures? Explain fully.

-

Discuss the reasons why a firm may repurchase its own common stock.

-

Explain the differences between par value, book value, and market value per share of common stock.

-

Explain how the OS and Utility programs work with application software. Summarize the features of several embedded operating systems course: introduction to information technology code: EBI...

-

Please explain and describe what are input and output devices. Explain what the differences are between an operating system, an embedded operating system, and a network operating system. Explain and...

-

Determine the complexity of the following pseudocode snippets in Big-O and Big-Q2. Do these code snippets have a Big-e? What are the functions doing? 1) my_func(some_nums) result = 0 for (num in...

Study smarter with the SolutionInn App