Question: In Section 10.3 we considered two production technologies for a new Wankel-engined outboard motor. Technology A was the most efficient but had no salvage value

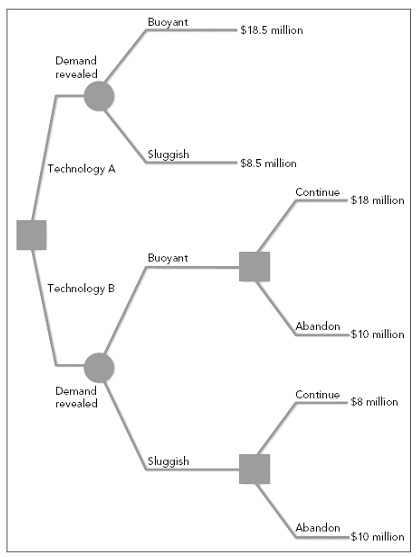

In Section 10.3 we considered two production technologies for a new Wankel-engined outboard motor. Technology A was the most efficient but had no salvage value if the new outboards failed to sell. Technology B was less efficient but offered a salvage value of $10 million.

Figure 10.7 shows the present value of the project as either $18.5 or 8.5 million in year 1 if Technology A is used. Assume that the present value of these payoffs is $11.5 million at year 0.

(a) With Technology B, the payoffs at year 1 are $18 or 8 million. What is the present value in year 0 if Technology B is used? The risk-free rate is 7 percent.

(b) Technology B allows abandonment in year 1 for $10 million salvage value. Calculate abandonment value

Buoyant $18.5 million Demand revealed Sluggish $8.5 million Technology A Continue $18 million Buoyant Technology B Abandon $10 million Demand revealed Continue $8 million Sluggish Abandon $10 million

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

a Technology B is equivalent to Technology A less a certain payment of 05 million Since PVA 115 mi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-O (51).docx

120 KBs Word File