Question: In the following table, General Electrics Balance Sheet from its 2005 annual report is shown. There are six columns of numbers. In the first two

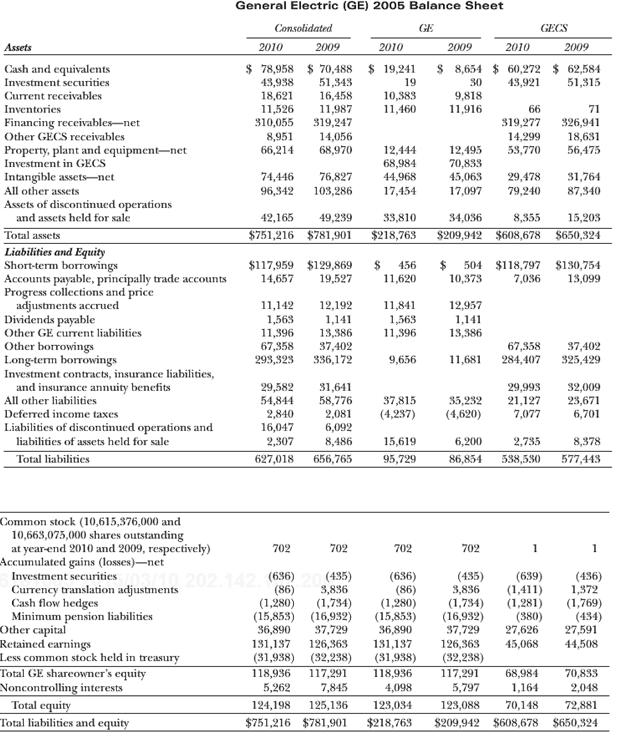

In the following table, General Electric’s Balance Sheet from its 2005 annual report is shown. There are six columns of numbers. In the first two columns, GE’s consolidated balance sheets for 2010 and 2009, respectively, are reported. The middle set of columns (listed under GE) represents GE’s unconsolidated balance sheet, which treats all controlled subsidiaries as investments. Finally, the last two columns, listed under GECS (General Electric Credit Services), represent the balance sheet for GE’s 100% owned subsidiary, GECS.

Required:

A. Examine the middle set of columns showing GE’s unconsolidated numbers. GE reports $68,984 as the investment in GECS. Which method does GE use to account for this investment, cost or equity method? Explain your answer.

B. Compare the consolidated totals for assets, liabilities, and equity to the totals for GE’s numbers unconsolidated. Which totals are different between the consolidated and the unconsolidated numbers? Explain why some numbers are the same when consolidated and why some numbers are different.

C. The noncontrolling interest reported for 2010 on the consolidated statement is $5,262. Is any of this related to GECS? Explain your answer. Under the new exposure drafts, predict whether minority interest will increase, decrease, or stay the same (keep in mind that GE has a large amount of goodwill reported in intangible assets).

D. In addition to reporting the consolidated numbers, GE also reports separate information on GE and GECS. What do we learn from this increased disclosure beyond what we might learn if only the consolidated numbers were reported? Suppose that GE reported on

GECS using the equity method and did not consolidate the subsidiary. Would this be misleading to the users of the financial statements? Why, or why not?

General Electric (GE) 2005 Balance Sheet Consolidated GE GECS Assets 2010 2009 2010 2009 2010 2009 $ 78,958 $ 70,488 $ 19,241 51,343 16,458 11,987 Cash and equivalents Investment securities $ 8,654 $ 60,272 43,921 62,584 51,315 43,938 19 30 9,818 11,916 Current reccivables 18,621 11,526 310,055 10,383 11,460 Inventories Financing receivables-net Other GECS receivables Property, plant and equipment-net Investment in GECS Intangible assets-net All other assets Assets of discontinued operations and assets held for sale 66 71 8,951 66,214 319,247 14,056 68,970 319,277 14,299 326,941 18,631 56,475 12,444 68,984 44,968 12,495 70,838 45,063 17,097 58,770 31,764 87,340 74,446 76,827 29,478 79,240 96,342 103,286 17,454 42,165 49,239 33,810 34,036 8,355 15,203 Total assets $751,216 $781,901 $218,763 $209,942 $608,678 $650,324 Liabilities and Equity Short-term borrowings Accounts payable, principally trade accounts Progress collections and price adjustments accrued Dividends payable Other GE current liabilities Other borrowings Long-term borrowings Investment contracts, insurance liabilities, and insurance annuity benefits All other liabilities $117,959 $129,869 14,657 $ 504 $118,797 10,373 $130,754 13,099 456 19,527 11,620 7,036 11,142 12,192 1,563 11,396 11,841 1,563 11,396 12,957 1,141 1,141 13,386 37,402 336,172 13,386 67,358 293,323 67,358 284,407 37,402 9,656 11,681 325,429 29,582 54,844 2,840 16,047 2,307 31,641 58,776 2,081 6,092 29,993 21,127 7,077 32,009 23,671 6,701 37,815 (4,237) 35,232 (4,620) Deferred income taxes Liabilities of discontinued operations and liabilities of assets held for sale 8,486 15,619 6,200 2,735 8,378 Total liabilities 627,018 656,765 95,729 86,854 538,530 577,443 Common stock (10,615,376,000 and 10,663,075,000 shares outstanding at year-end 2010 and 2009, respectively) Accumulated gains (losses)-net Investment securities Currency translation adjustments Cash flow hedges Minimum pension liabilities Other capital Retained earnings Less common stock held in treasury Total GE shareowner's equity Noncontrolling interests Total equity Total liabilities and equity 702 702 702 702 1 1 (435) 3,836 (1,734) (16,932) 37,729 (435) 3,836 (636) (86) (1,280) (15,853) (16,932) 36,890 131,137 (31,938) (636) (86) (1,280) (15,853) 36,890 (639) (1,411) (1,281) (380) 27,626 45,068 (436) 1,372 (1,769) (434) 27,591 44,508 03/00 (1,734) 37,729 131,137 (31,938) 126,363 126,363 (32,238) (32,238) 118,936 5,262 117,291 7,845 118,936 4,098 117,291 68,984 1,164 70,833 2,048 5,797 124,198 125,136 123,034 123,088 70,148 72,881 $751,216 $781,901 $218,763 $209,942 $608,678 $650,324

Step by Step Solution

3.34 Rating (169 Votes )

There are 3 Steps involved in it

A GE uses the equity method to account for the investment in GECS The investment account on GEs books has a balance of 68984 and 70833 for the years 2010 and 2009 respectively Notice that the balance ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

417-B-A-G-F-A (5909).docx

120 KBs Word File