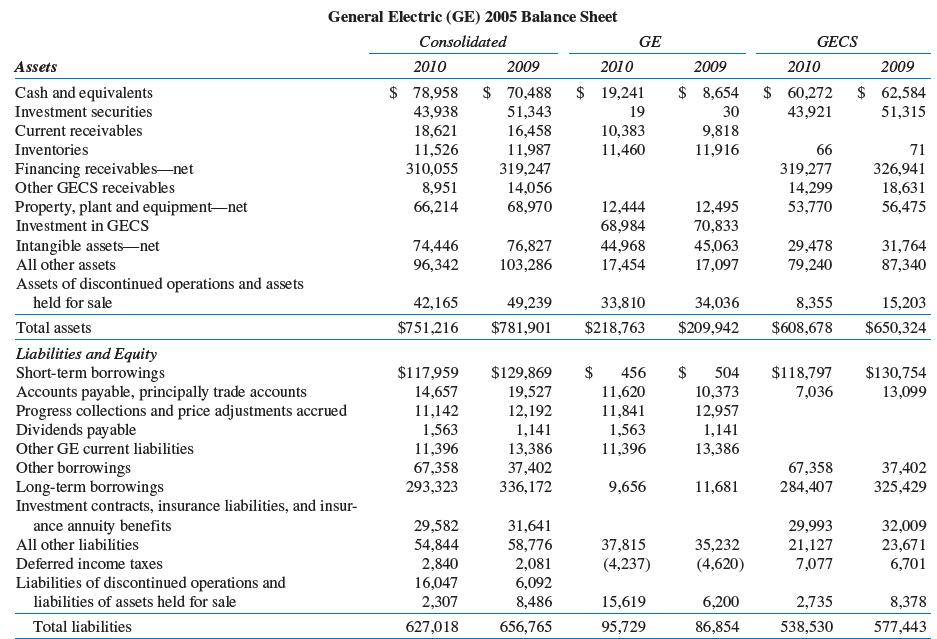

In the following table, General Electrics Balance Sheet from its 2010 annual report is shown. There are

Question:

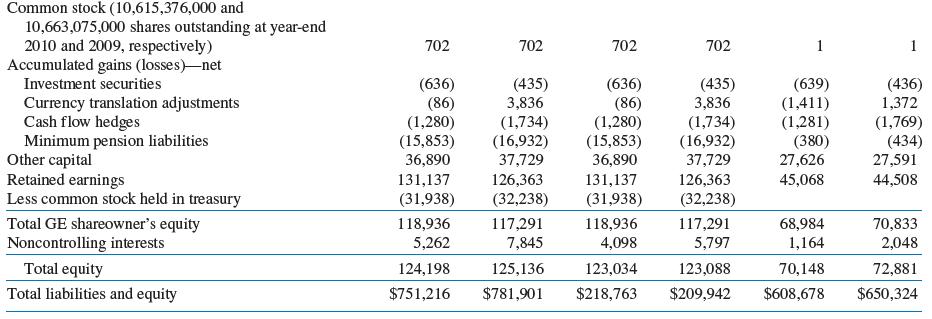

In the following table, General Electric’s Balance Sheet from its 2010 annual report is shown. There are six columns of numbers. In the first two columns, GE’s consolidated balance sheets for 2010 and 2009, respectively, are reported. The middle set of columns (listed under GE) represents GE’s unconsolidated balance sheet, which treats all controlled subsidiaries as investments. Finally, the last two columns, listed under GECS (General Electric Credit Services), represent the balance sheet for GE’s 100% owned subsidiary, GECS.

Required:

A. Examine the middle set of columns showing GE’s unconsolidated numbers. GE reports $68,984 as the investment in GECS. Which method does GE use to account for this investment, cost or equity method? Explain your answer.

B. Compare the consolidated totals for assets, liabilities, and equity to the totals for GE’s numbers unconsolidated. Which totals are different between the consolidated and the unconsolidated numbers? Explain why some numbers are the same when consolidated and why some numbers are different.

C. If the acquisition were to result in noncontrolling interest (NCI) under current GAAP, how would that NCI be valued in the consolidated balance sheet?

a. NCI percentage times the book value of identifiable net assets

b. NCI percentage times the fair value of identifiable net assets

c. NCI percentage times the book value of tangible net assets

d. NIC percentage times the fair value of tangible net assets

D. In addition to reporting the consolidated numbers, GE also reports separate information on GE and GECS. What do we learn from this increased disclosure beyond what we might learn if only the consolidated numbers were reported? Suppose that GE reported on GECS using the equity method and did not consolidate the subsidiary. Would this be misleading to the users of the financial statements? Why, or why not?

Step by Step Answer: