Question: Jefferson Mountain is a small ski resort located in central Pennsylvania. In recent years, the resort has experienced two major problems: (1) unusually low annual

Jefferson Mountain is a small ski resort located in central Pennsylvania. In recent years, the resort has experienced two major problems: (1) unusually low annual snowfalls and (2) long lift lines. To remedy these problems, management is considering two investment proposals. The first involves a $125,000 investment in equipment used to make artificial snow. The second involves the $180,000 purchase of a new high-speed chairlift.

The most that the resort can afford to invest at this time is $200,000. Thus, it cannot afford to fund both proposals. Choosing one proposal over the other is somewhat problematic. If the resort funds the snow-making equipment, business will increase, and lift lines will become even longer than they are currently. If it funds the chairlift, lines will be shortened, but there may not be enough natural snow to attract skiers to the mountain.

The following estimates pertain to each of these investment proposals:

-1.png)

Neither investment is expected to have any salvage value. Furthermore, the only difference between incremental cash flow and incremental income is attributable to depreciation. Due to inherent risks associated with the ski industry and the resort’s high cost of capital, a minimum return on investment of 20 percent is required.

Instructions

a. Compute the payback period of each proposal.

b. Compute the return on average investment of each proposal.

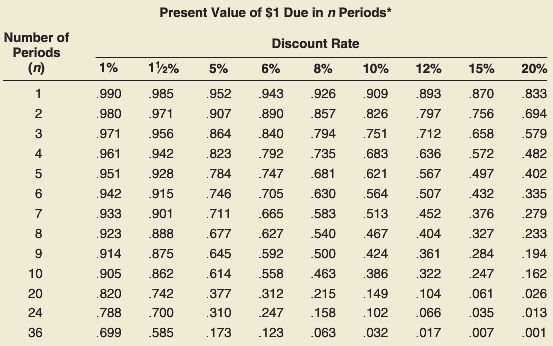

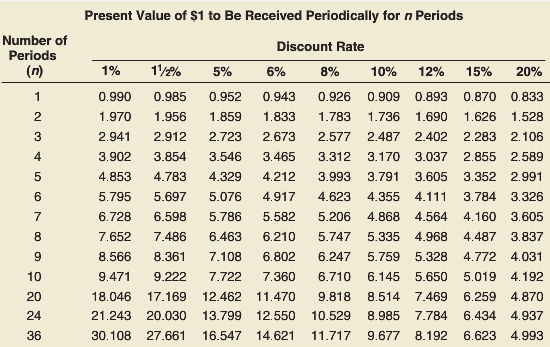

c. Compute the net present value of each proposal using the tables in Exhibits 26–3 and 26–4.

d. What nonfinancial factors should be considered?

e. Which proposal, if either, do you recommend as a capital investment?

In Exhibits 26–3

In Exhibits 26–4

Snow-Making Equipment Chairlift 20 years 36 years $54,000 19,000 Estimated incremental annual revenue of investment . . . Estimated incremental annual expense of investment $40,000 15,000 Present Value of $1 Due in n Periods* Number of Periods Discount Rate 1% 1 % 5% 990 .985 980 971 971 956 961942 951.928 942 915 933 901 923 888 914 875 905 862 820742 788 700 699 6% 8% 10% 12% 15% 20% 952 943926 99 893 870 833 907 890 87 82797756 694 864840 794 751 712 658 579 823 792 735 683 636 572 482 784 74768 621 567 497 402 746 705 630 564 507 432 35 711 665 583 513 452376 279 677 627 540 47404327 233 645 592 500 424284 194 614 558 463 386 322 47162 377 312 215 49 104061 026 310 2478 102 066 035 013 173 123 063 032 017 007 001 2 3 4 6 7 10 20 24 36 585

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

a Payback periods The supporting calculations are Incremental annual revenue of investment 40000 Les... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

290-B-C-A-B (848).docx

120 KBs Word File