Question: John Williams (age 42) is a single taxpayer, and he lives at 1324 Forest Dr., Reno, NV 89501. His Social Security number is 555949358. Johns

John Williams (age 42) is a single taxpayer, and he lives at 1324 Forest Dr., Reno, NV 89501. His Social Security number is 555949358. John’s earnings and withholdings as the manager of a local casino for 2014 are:

Earnings from the Lucky Ace Casino………………………………. $195,000

Federal income tax withheld……………………………………….. 32,000

State income tax withheld………………………………………….. 0

John’s other income includes interest on a savings account at Nevada National Bank of $13,075.

John pays his ex wife $4,000 per month. When their 12yearold child (in the wife’s custody) reaches 18, the payments are reduced to $2,800 per month. His ex wife’s Social Security number is 554445555.

During the year, John paid the following amounts (all of which can be substantiated):

Credit card interest……………………………………………… 1,760

Auto loan interest……………………………………………….. 4,300

Auto insurance…………………………………………………… 900

Property taxes on personal residence……………………………. 6,200

Blue Cross health insurance premiums…………………………... 1,800

Other medical expenses………………………………………….. 790

Income tax preparation fee………………………………………. 900

Charitable contributions:

Boy Scouts………………………………………………………. 800

St. Matthews Church……………………………………………. 300

U. of Nevada (Reno) Medical School…………………………... 30,000

Nevada Democratic Party……………………………………….. 250

Fundraising dinner for the Reno Auto Museum………………… 100

(value of dinner is $50)

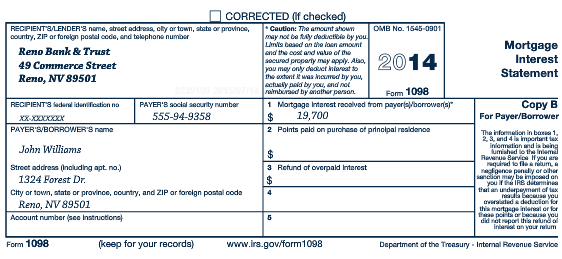

John also received the following Form 1098:

Required:

Complete John’s federal tax return for 2014. Use Form 1040, Schedule A, and Schedule B, from Pages 551 through 554 to complete this tax return. Make realistic assumptions about any missing data.

CORRECTED (f checked RECPIENTa/LENDER3 nams, abeat oddroa cy ortowm, abata or pravina, oountry, ZIP or toroign paatel codo, and tolaphone numbar Caution: Tra amount ahoun OME No. 15450901 Mortgage Interest Statement Lime oeaed onthalonsmaunt nd th Reno Bank & Trust 49 Commerce Street Reno, NV 89501 2014 he atont was neumed by you echsaiy pela by yo, sna not ambraed by mot 1 Martgago Intarest reoalved from payer/bomowens Fomm 1098 Copy B For Payer/Borrower $19,700 2 Points pald on purchasa of propal a danoa 555-94-9358 PAYER'S/BORROWERS nama John Williams Strect addrass (nauding apt no) 3 Rafund af overpald Intarest 1324 Forest Dr. City or towwn, state or pravince, country, and ZIP or torcign postal coda 4 Reno, NV 89501 Aooount number (ce Inatructione Form 1098 (keep for your records www.ira.govform1098 Depertment ot the Treasury Internal Rewenuc Sarvlo0

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Calculations for explanation Calculation Of Federal income Tax payable or Refund Due Amount Explanation Description Gross Income Salary Of John 195000 Interest Income from Nevada National Bank 13075 G... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

495-B-A-I-T (977).docx

120 KBs Word File