Foxwood Company is a metal- and woodcutting manufacturer, selling products to the home construction market. Consider the

Question:

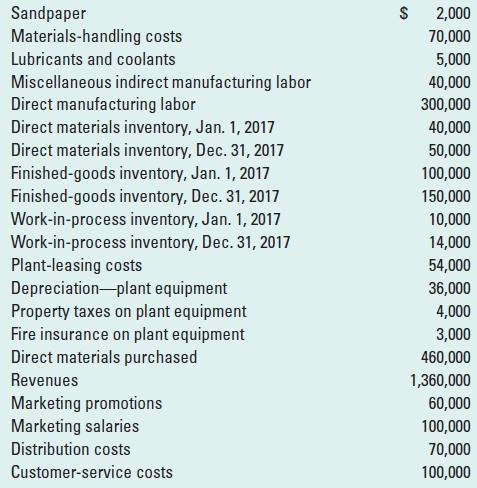

Foxwood Company is a metal- and woodcutting manufacturer, selling products to the home construction market. Consider the following data for 2017:

Required

1. Prepare an income statement with a separate supporting schedule of cost of goods manufactured.

For all manufacturing items, classify costs as direct costs or indirect costs and indicate by V or F whether each is a variable cost or a fixed cost (when the cost object is a product unit). If in doubt, decide on the basis of whether the total cost will change substantially over a wide range of units produced.

2. Suppose that both the direct material costs and the plant-leasing costs are for the production of 900,000 units. What is the direct material cost of each unit produced? What is the plant-leasing cost per unit? Assume that the plant-leasing cost is a fixed cost.

3. Suppose Foxwood Company manufactures 1,000,000 units next year. Repeat the computation in requirement 2 for direct materials and plant-leasing costs. Assume the implied cost-behavior patterns persist.

4. As a management consultant, explain concisely to the company president why the unit cost for direct materials did not change in requirements 2 and 3 but the unit cost for plant leasing costs did change.

Step by Step Answer: