Melbourne Co. is a large integrated Australian conglomerate with shipping, metals, and mining operations throughout Asia. Melbourne

Question:

Melbourne Co. is a large integrated Australian conglomerate with shipping, metals, and mining operations throughout Asia. Melbourne is just starting a new manufacturing division and the newly appointed general manager plans to submit a proposed capital budget for 20X8 for inclusion in the company-wide budget.

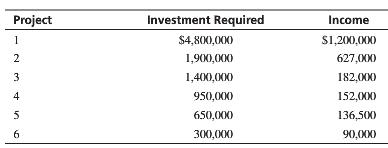

The division manager has for consideration the following projects, all of which require an outlay of capital. All projects have equal risk.

The division manager must decide which of the projects to take. The company has a cost of capital of 20%. An amount of $12 million is available to the division for investment purposes.

1. What will be the total investment, total return, return on capital invested, and economic profit of the rational division manager if

a. the company has a rule that managers should accept all projects promising a return on investment of at least 15%?

b. the company evaluates division managers on the return on capital invested (assume this is a new division so that invested capital will consist only of capital invested in new projects adopted by the manager)?

c. the division manager is expected to maximize economic profit computed using the 20% cost of capital?

2. Which of the three approaches will induce the most effective investment policy for the company as a whole? Explain.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta