Question: (Multiple choice) Use the Buffalo Bell Corporation financial statements that follow to answer questions 1 through 6. 1. Buffalo Bells days sales in average receivables

(Multiple choice)

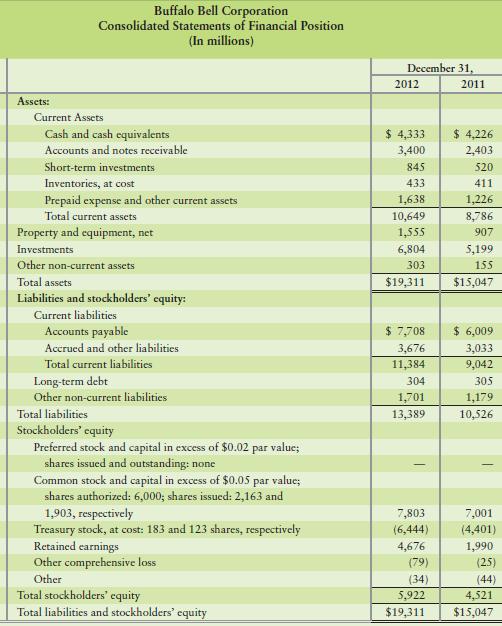

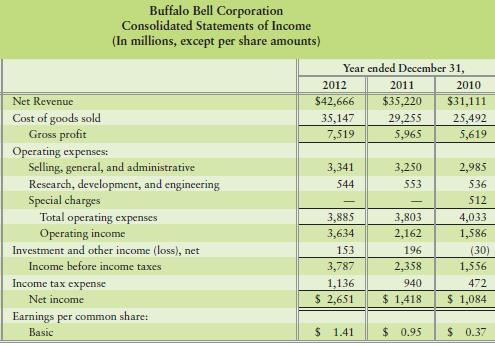

Use the Buffalo Bell Corporation financial statements that follow to answer questions 1 through 6.

1. Buffalo Bell’s days’ sales in average receivables during 2012 was

a. 137.9 days.

b. 20.1 days.

c. 35 days.

d. 25 days.

2. Buffalo Bell’s inventory turnover during fiscal year 2012 was

a. $35,147.

b. very slow.

c. 83 times.

d. 137.9 times.

3. Buffalo Bell’s long-term debt bears interest at 11%. During the year ended December 31, 2012, Bell’s times-interest-earned ratio was

a. 137.9 times.

b. $35,147.

c. 108 times.

d. 20.1 times.

4. Buffalo Bell’s trend of return on sales is

a. worrisome.

b. declining.

c. stuck at 22.1%.

d. improving.

5. How many shares of common stock did Buffalo Bell have outstanding, on average, during 2012?

a. 1,880 million

b. 137.9 million

c. 20.1 million

d. 35,147 million

6. Book value per share of Buffalo Bell’s common stock outstanding at December 31, 2012, was

a. 137.9.

b. $35,147.

c. $2.99.

d. 20.1.

Buffalo Bell Corporation Consolidated Statements of Financial Position (In millions) December 31, 2012 2011 Assets: Current Assets $ 4,333 $ 4,226 Cash and cash equivalents Accounts and notes receivable 3,400 2,403 Short-term investments 845 520 Inventories, at cost 433 411 Prepaid expense and other current assets Total current assets 1,638 1,226 10,649 1,555 8,786 Property and equipment, net 907 Investments 6,804 5,199 Other non-current assets 303 155 Total assets $19,311 $15,047 Liabilities and stockholders' cquity: Current liabilities $ 7,708 3,676 $ 6,009 Accounts payable Accrued and other liabilities 3,033 Total current liabilities 11,384 9,042 Long-term debt 304 305 Other non-current liabilities 1,179 1,701 Total liabilities 10,526 13,389 Stockholders' equity Preferred stock and capital in excess of $0.02 par valuc; shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issucd: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively Retained earnings Other comprehensive loss 7,803 7,001 (6,444) (4,401) 4,676 1,990 (79) (25] (34) 5,922 Other (44) Total stockholders' equity 4,521 Total liabilities and stockholders' equity $19,311 $15,047

Step by Step Solution

3.41 Rating (173 Votes )

There are 3 Steps involved in it

1 2 3 4 in 5 6 d d a 3400 24032 42666365 EPS 141 35147 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

247-B-M-A-F-S-A (1208).docx

120 KBs Word File