Question: Now place yourself exactly in the same setting as before, where the market quotes the above R. It just happens that you have a close

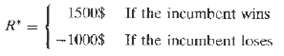

Now place yourself exactly in the same setting as before, where the market quotes the above R. It just happens that you have a close friend who offers you the following separate bet, R*:

Note that Tue random event behind this bet is the same as in R. Now consider the following:(a) Using the R and the R*, construct a portfolio of bets such that you gt a guaranteed risk-free return (assuming that your friend or the market does not default).(b) Is the value of the probability p important in selecting this portfolio? Do you care what the p is? Suppose you are given the R, but the payoff of R* when the incumbent wins is an unknown to be determined. Can the above portfolio help you determine this unknown value?(c) What role would a statistician of econometrician play in making all these decisions? Why?

If the incumbent wins If the incumbent loses 1500$ R* - 1000$

Step by Step Solution

3.35 Rating (173 Votes )

There are 3 Steps involved in it

a One could go long R and short R The risk free pay... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

41-B-F-F-M (23).docx

120 KBs Word File