NPV and IRR Anderson International Limited is evaluating a project in Erewhon. The project will create the

Question:

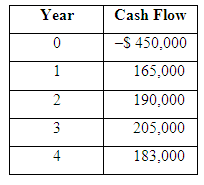

NPV and IRR Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows:

All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these finds is 4 percent. If Anderson uses an 11 percent required return oil this project, what are the NPV and IRR of the project? Is the 1RR you calculated the M1RR of the project why or whyNot?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0077861629

8th Edition

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan

Question Posted: