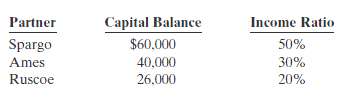

Question: On December 31, the capital balances and income ratios in SAR Company are as follows. Instructions(a) Journalize the withdrawal of Ruscoe under each of the

On December 31, the capital balances and income ratios in SAR Company are as follows.

Instructions(a) Journalize the withdrawal of Ruscoe under each of the following assumptions.

(1) Each of the continuing partners agrees to pay $18,000 in cash from personal funds to purchase Ruscoe?s ownership equity. Each receives 50% of Ruscoe?s equity.

(2) Ames agrees to purchase Ruscoe's ownership interest for $25,000 cash.(3) Ruscoe is paid $34,000 from partnership assets, which includes a bonus to the retiring partner.(4) Ruscoe is paid $22,000 from partnership assets, and bonuses to the remaining partners are recognized.(b) If Ames's capital balance after Ruscoe's withdrawal is $42,400, what were (1) the total bonus to the remaining partners and (2) the cash paid by the partnership toRuscoe?

Partner Income Ratio Capital Balance Spargo Ames $60,000 40,000 26,000 50% 30% 20% Ruscoe

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

a 1 Ruscoe Capital 26000 Spargo Capital 13000 Ames Capital 13000 2 Ruscoe Capit... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

54-B-A-P (212).docx

120 KBs Word File