Question: On July 1, 2019, Grams Construction, Inc. agreed to construct a factory for a customer. The contract called for payments to Grams totaling $2 million.

On July 1, 2019, Grams Construction, Inc. agreed to construct a factory for a customer. The contract called for payments to Grams totaling $2 million. Grams have correctly determined that it is appropriate to recognize revenue over time, and it uses its costs as a measure of completion. The same cost information is used to determine the portion of the contract price Grams is entitled to receive.

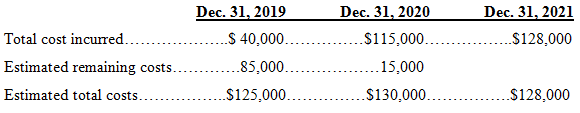

The following information describes the costs incurred and expected remaining costs at December 31, 2019 and 2020.

The factory is completed on January 31, 2021.

Required:

Determine the amount of revenue Grams reports related to the above factory in 2019, 2020, and 2021.

Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 Total cost incurred.. Estimated remaining costs. S 40,000... .85,000.. $128,000 $115,000... .15,000 .$128,000 Estimated total costs .$125,000.. .$130,000..

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

At the end of each year Grams must determine the cumulative am... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1237-B-C-A-C-A(3245).docx

120 KBs Word File