Question: Refer to the information in exercise 20-27. In exercise 20-27, Somerfeld Company is a manufacturer of auto parts having the following financial statements for 20092010.

Refer to the information in exercise 20-27.

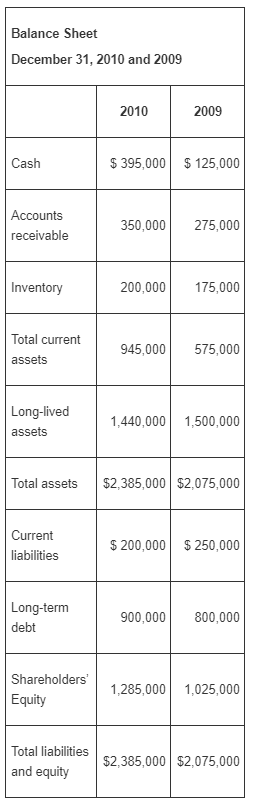

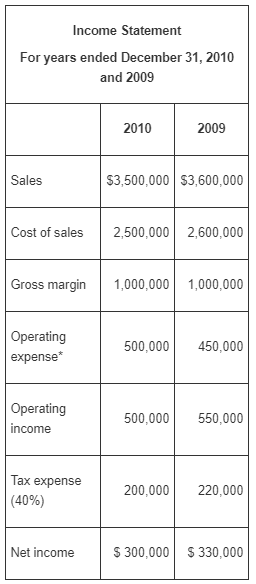

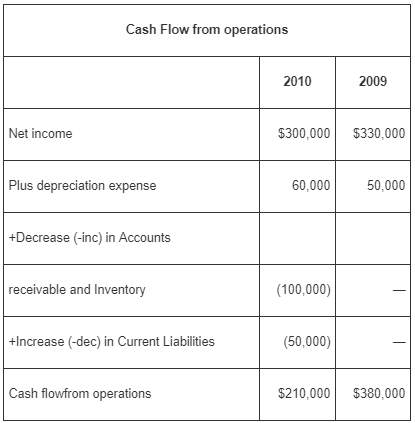

In exercise 20-27, Somerfeld Company is a manufacturer of auto parts having the following financial statements for 2009–2010.

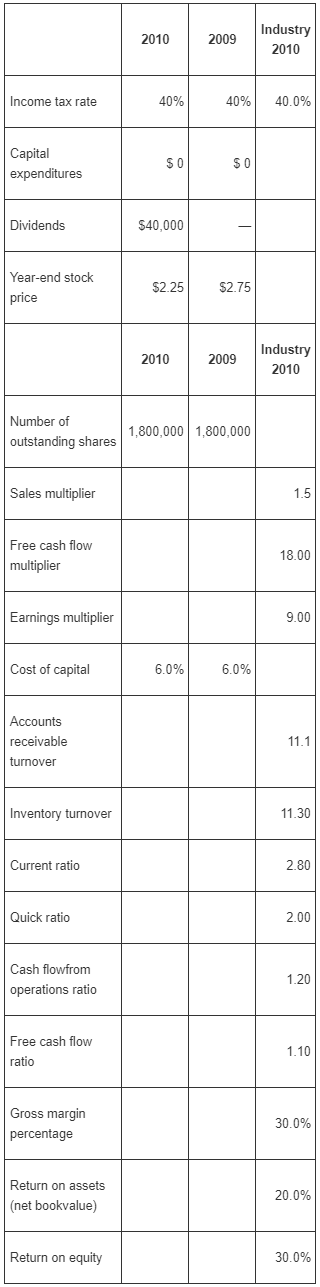

Additional financial information, including industry averages for 2010, where appropriate:

Required

Develop a business valuation for Somerfeld Company for 2010 using the following methods: (1) book value of equity, (2) market value of equity, (3) discounted cash flow (DCF), (4) enterprise value, and (5) all the multiples-based valuations for which there is an industry average multiplier. For the calculation of the DCF valuation, you may use the simplifying assumption that free cash flows will continue indefinitely at the amount in2010.

Balance Sheet December 31, 2010 and 2009 2010 2009 $ 395,000 Cash $ 125,000 Accounts 350,000 275,000 receivable 200,000 175,000 Inventory Total current 575,000 945,000 assets Long-lived 1,440,000 1,500,000 assets $2,385,000 $2,075,000 Total assets Current $ 200,000 $ 250,000 liabilities Long-term 800,000 900,000 debt Shareholders' 1,285,000 1,025,000 Equity Total liabilities $2,385,000 $2,075,000 and equity

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

The book value market value DCF enterprise value and multiplesbased valuations for Somerfeld for 201... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

249-B-M-L-G-M (559).xlsx

300 KBs Excel File