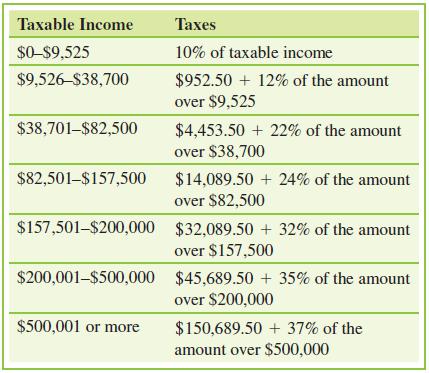

The federal Income tax rate schedule for a person filing a single return in 2018 is shown

Question:

The federal Income tax rate schedule for a person filing a single return in 2018 is shown below. a) Shenile works as a student tutor and paid $876 in federal taxes in 2018. Determine Shenile’s taxable income.

a) Shenile works as a student tutor and paid $876 in federal taxes in 2018. Determine Shenile’s taxable income.

b) Logan works as a caddy at a golf course and paid $2017.50 in federal taxes in 2018. Determine Logan’s taxable income.

Transcribed Image Text:

Taxable Income Taxes $0-59,525 10% of taxable income $9,526-S38,700 $952.50 + 12% of the amount over $9,525 $38,701-$82,500 $4,453.50 + 22% of the amount over $38,700 $82,501–$157,500 $14,089.50 + 24% of the amount over $82,500 $157,501-$200,000 $32,089.50 + 32% of the amount over $157,500 $200,001-$500,000 $45,689.50 + 35% of the amount over $200,000 $500,001 or more $150,689.50 + 37% of the amount over $500,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a Since 876 is less than 10 9525 95250 Sheniles tax was 10 of her taxabl...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

A Survey Of Mathematics With Applications

ISBN: 9780135740460

11th Edition

Authors: Allen R. Angel, Christine D. Abbott, Dennis Runde

Question Posted:

Students also viewed these Mathematics questions

-

Use the federal income tax rate schedule for a person filing a single return in 2018 shown in Exercise 23 to answer the following questions. a) Lewis works as a waiter and paid $4541.50 in federal...

-

The federal income tax rate schedule for a joint return in 2014 is illustrated in the table below. If the Marquez family paid $12,715 in federal taxes, determine the familys adjusted gross income....

-

In reviewing the tax rate schedule for a single taxpayer, Chuck notes that the tax on $75,000 is $5,226.25 plus 25 percent of the taxable income over $37,950. What does the $5,226.25 represent?

-

For this final discussion board, please reflect back on your accounting courses and answer the following questions: 1. Which course in the accounting program did you find to be the most difficult? 2....

-

From secondary data sources, obtain sales for an entire industry and the sales of the major firms in that industry for any year. Compute the market shares of each major firm. Using another source,...

-

Assume that a file named scores.txt exists on the computers disk. It contains a series of records, each with two fields a name, followed by a score (an integer between 1 and 100). Write a program...

-

How would a company know that its product or service was preferred in the marketplace? What could a competitor do to erode this favorable position?

-

How does deferred or unearned revenue arise? Why can it be classified properly as a current liability? Give several examples of business activities that result in unearned revenues.

-

Describe five common fees assessed on credit card accounts and how they can be avoided. What is the major benefit of having a credit card with a grace period?

-

What is output of the following program? #include using namespace std; int x = 19; int main () { int x = 21; { int x = 41; cout <

-

Use inductive reasoning to predict the next three numbers in the pattern (or sequence). 1, 1, 2, 4, 7, 11, . . .

-

Use inductive reasoning to predict the next three numbers in the pattern (or sequence). 0, 1, 3, 6, 10, 15, . . . . .

-

Describe the advantages and disadvantages of using CPFR. Do you think the advantages outweigh the disadvantages? What firms would get the greatest benefits from using CPFR?

-

Why is market research an essential tool for the marketing manager?

-

Why is post-purchase evaluation important for: (a) the consumer? (b) the marketer?

-

One of the biggest challenges for student writers is paraphrasing secondary sources correctly to avoid plagiarism. Your Task. For each of the following, read the original passage. Analyze the...

-

Design a questionnaire. It should contain about 20 questions and you should use as many of the different types of question as possible. Pay particular attention to the concerns discussed. The...

-

Many consumers rely on product reviews posted online, presumably by ordinary citizens describing their authentic experiences. Unfortunately, though, Amazon and Yelp, the most prominent of the many...

-

The local Japanese-style steakhouse expects sales to be $500,000 in January. The average restaurant bill is $50. Only 25% of restaurant bills are paid in cash, while 70% are paid with credit cards...

-

on 8 For the following set of lengths 130, 170, 160, 160, 150, 190 Third quartile is: et red d out of Select one: O a. 160 a question O b. 145 O c. 175 O d. 180

-

Apple makes iPhones and Dell makes canoes, or Hewlett Packard makes laser printers. Determine the truth value of the statement. You may need to use a reference such as the Internet or an encyclopedia.

-

Construct a truth table for the statement. (p q) (~ q r)

-

It is false that Mr. Farinelli is the president or that Ms. Chow is the treasurer. Write the statement in symbolic form and construct a truth table.

-

blem 3: Consider the soil profile below. If the effective stress at point C is 111 kPa, find the value of h. (30) e=0.61 Gs=2.66 Ground Surface 4m 5m e=0.48 Gs=2.67 A PP A

-

Q4 (40 marks). Two identical rigid foundations are given. Calculate the differential settlement ratio (8/L) after 100 days and long term after construction of the foundations. Hint: Average total...

-

An embankment is given (H = 5 m and y = 20 kN/m). Determine the vertical stress increase at points A, which is 5 m below the ground surface. Assume the embankment is constructed on the ground...

Study smarter with the SolutionInn App