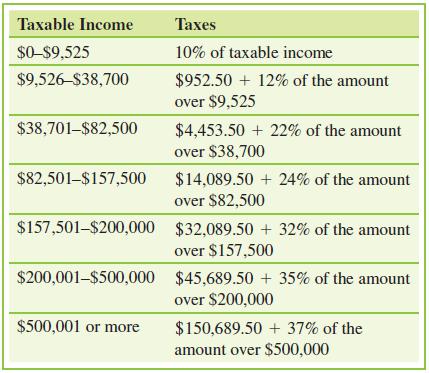

Use the federal income tax rate schedule for a person filing a single return in 2018 shown

Question:

Use the federal income tax rate schedule for a person filing a single return in 2018 shown in Exercise 23 to answer the following questions.

a) Lewis works as a waiter and paid $4541.50 in federal taxes in 2018. Determine Lewis’s taxable income.

b) Leticia works as an occupational therapist and paid $14,593.50 in federal taxes in 2018. Determine Leticia’s taxable income.

Data From Exercise 23:

The federal Income tax rate schedule for a person filing a single return in 2018 is shown below.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

A Survey Of Mathematics With Applications

ISBN: 9780135740460

11th Edition

Authors: Allen R. Angel, Christine D. Abbott, Dennis Runde

Question Posted: