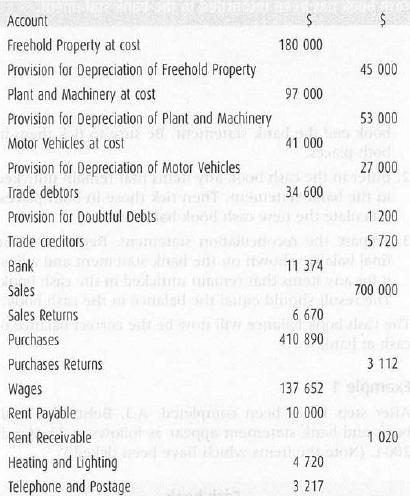

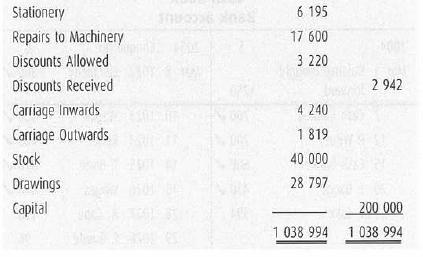

Saul is a trader and his trial balance at 31 May 2004 was as follows. Further information

Question:

Saul is a trader and his trial balance at 31 May 2004 was as follows.

Further information

1. Stock at 31 May 2004 cost $58 000.

2. Depreciation is to be calculated as follows: freehold property at 4% per annum, straight line; plant and machinery at 15% per annum; motor vehicles at 30% per annum on the reducing balance.

3. Included in trade debtors is a bad debt of $1800; the provision for doubtful debts is to be 5% of trade debtors.

4. $400 was owing for heating and lighting, and $220 for stationery. The stock of stationery at 31 May 2004 had cost $450.

5. Rent paid in advance was $2000; rent receivable was owing in the sum of $280.

6. Saul had taken goods for his own use. The goods had cost $2400. No entries for this had been made in the books.

Required

(a) Prepare Saul's Trading and Profit and Loss Account for the year ended 31 May 2004.

(b) Prepare the Balance Sheet at 31 May 2004.

Step by Step Answer: