Wilfrid, Hide and Wyte were partners sharing profits and losses in the ratio of 3 : 2

Question:

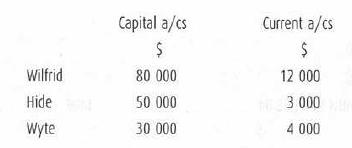

Wilfrid, Hide and Wyte were partners sharing profits and losses in the ratio of 3 : 2 : 1 after charging interest on capitals at 10% per annum. Their Capital and Current account balances at 1 July 2003 were as follows.

Wilfrid decided to retire on 31 December 2003. He left $75 000 of the balance on his Capital account as a loan to the firm, with interest at 10% per annum. The balance on his Capital account was paid to him by cheque.

At 31 December 2003, Goodwill was valued at $60 000 but Goodwill was not to be shown in the books. It was also agreed that the partnership assets should be revalued at $21 000 less than their current book values.

Hide and Wyte continued in partnership from 1 January 2004, with interest allowed on capitals at 10% per annum and with profits and losses being shared equally.

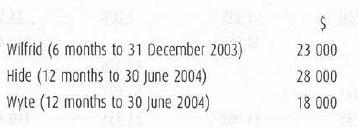

The partners' drawings in the year ended 30 June 2004 were as follows.

Further information

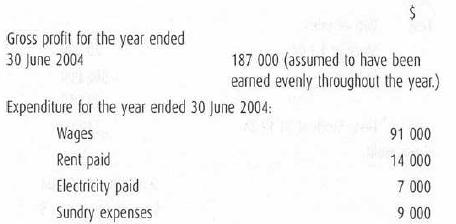

1.

2. At 30 June 2004, rent of $2000 had been paid in advance, and electricity in the amount of $1400 had accrued.

Required

(a) Prepare the partnership Profit and Loss and Appropriation Account for the year ended 30 June 2004.

(b) Prepare the Capital and Current accounts of the partnership for the year ended 30 June 2004.

Step by Step Answer: