Kelly and Leo have been in partnership for a number of years sharing profits and losses in

Question:

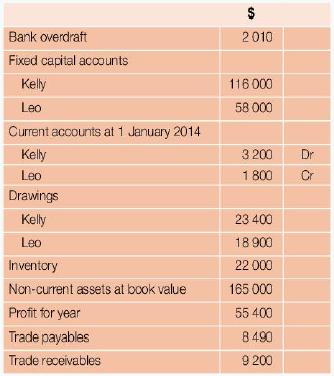

Kelly and Leo have been in partnership for a number of years sharing profits and losses in the ratio of their fixed capitals. The following balances appeared in the partnership's books at 31 December 2014 after completion of the income statement for the year ended on that date.

The partnership agreement provides that;

• Interest should be charged on drawings: Kelly $1300; Leo $900

• Interest on capital of 5 percent per annum should be credited to each partner a Give one reason why the partners have chosen to have fixed capitals.

b. Prepare an appropriation account for the year ended 31 December 2014.

c. Prepare Kelly's current account for the year ended 31 December 2014.

On 1 January 2015 the partners agreed to the admission of Martin as a partner. The following terms were agreed.

• Non-current assets should be revalued at $152,000.

• A provision for doubtful debts should be created of 5 percent of trade receivables.

• Inventory should be revalued as it appears that items valued at $1340 are out of date and should be disposed of. In addition, 50 items which cost $18 are damaged and have a resale value of only $21 after repair costs estimated at $350 has been paid.

• Goodwill is to be valued at $60,000 but will not be recorded in the books of account.

• Martin is to introduce $80,000 as his fixed capital contribution.

• In the new partnership profits will be shared: Kelly 45 percent. Leo 25 percent, Martin 30 percent.

• Partners would continue to use current accounts.

• All adjustments required for the admission of Martin should be made through the partners' capital accounts.

d. Prepare the capital accounts of the partners showing the admission of Martin assuming the terms of admission were implemented on 1 January 2015.

e. Discuss the potential benefits and drawbacks of admitting Martin as a partner other than the introduction of additional capital.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone