Assume that each of the returns in Table 6.18 represent stocks with a value of $100. Assuming

Question:

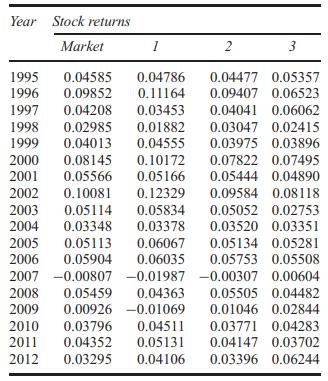

Assume that each of the returns in Table 6.18 represent stocks with a value of $100. Assuming a discount rate of 4 percent compute the price of the call option using the Black-Scholes formula at time T = 0. 75 (nine months into the future) for a strike price of $95.

Table 6.18

Transcribed Image Text:

Year Stock returns Market 1 2 3 1995 0.04585 0.04786 0.04477 0.05357 1996 0.09852 0.11164 1997 0.04208 1998 0.02985 0.09407 0.06523 0.03453 0.04041 0.06062 0.01882 0.03047 0.02415 1999 0.04013 0.04555 0.03975 0.03896 2000 2001 2002 0.08145 0.10172 0.05566 0.10081 0.12329 0.07822 0.07495 0.05166 0.05444 0.04890 0.09584 0.08118 2003 0.05114 0.05834 0.05052 0.02753 2004 0.03348 0.03378 0.03520 0.03351 2005 0.05113 0.06067 0.05134 0.05281 2006 0.05904 0.06035 0.05753 0.05508 2007 -0.00807 -0.01987 -0.00307 0.00604 2008 0.05459 0.04363 0.05505 0.04482 2009 0.00926 -0.01069 0.01046 0.02844 2011 2012 2010 0.03796 0.04511 0.04352 0.05131 0.03295 0.04106 0.03771 0.04283 0.04147 0.03702 0.03396 0.06244

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Mehwish Aziz

What I have learnt in my 8 years experience of tutoring is that you really need to have a friendly relationship with your students so they can come to you with their queries without any hesitation. I am quite hardworking and I have strong work ethics. Since I had never been one of those who always top in the class and always get A* no matter what, I can understand the fear of failure and can relate with my students at so many levels. I had always been one of those who had to work really hard to get decent grades. I am forever grateful to some of the amazing teachers that I have had who made learning one, and owing to whom I was able to get some extraordinary grades and get into one of the most prestigious universities of the country. Inspired by those same teachers, I am to be like one of them - who never gives up on her students and always believe in them!

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

"internet radios" for streaming audio, and personal video recorders and players. Describe design and evaluation processes that could be used by a start-up company to improve the usability of such...

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

The species-area curve tells us that slowing or halting___________ ___________ will potentially slow the rate of extinction.

-

What produces an electromagnetic wave?

-

The composite plate is made from both steel (A) and brass (B) segments. Determine the mass and location (xc, yc, zc) of its mass center G. Units Used: Mg = 1000 kg Given: st = 7.85Mg/m 3 a = 150 mm b...

-

Use the technique discussed in Section9.4 to develop a GEE approach for zeroinflated Poisson model for count responses in longitudinal studies. Section9.4: 9.4 Marginal Models for Longitudinal Data...

-

Swartz Publishing identified the following overhead activities, their respective costs, and their cost drivers to produce the three types of textbooks the company publishes. Deluxe textbooks are made...

-

Find the two unknown sides in this triangle. Keep 4 significant digits. x+3.10m -240m-x 5.21m

-

What is the principle of increasing risk?

-

Using the data in Table 6.18 estimate the capital asset pricing model betas. Using these estimates, compute the risk adjusted discount rate. Table 6.18 Year Stock returns Market 1 2 3 1995 0.04585...

-

A child destined to succeed in life has high self-esteem. Therefore, a child with low self-esteem is not destined to succeed in life. Translate the premise and conclusion of the following immediate...

-

Examine the Charismatic and Transformational Leadership Styles as an Emotional Approach to organizational change with the help of relevant examples.

-

Prudential Ltd makes 4 products, P, Q, R and S from the same materials. The sale price and variable cost per unit are as follows: Explain the term 'limiting factor'. Material A @ RM12/kg Material B...

-

Microeconomics is the study of the economic activities of individuals and firms. In other words, it examines how individuals and companies within an economic system behave. Specifically, it examines...

-

Firebird's current EBIT is 1,963, and its current interest expense is 650. It has a current capital spending of 146 and a current depreciation and amortization of 28. The effective tax rate and...

-

Case Study Name: BENGALURU CRISIS LEADERSHIP THROUGH A PANDEMIC How did Prem Watsa's stated expectations for Hari Marar influence the BIAL leadership's approach to managing the COVID-19 crisis?...

-

Suppose you decide to travel to a star 85 light-years away at a speed that tells you the distance is only 25 light-years. How many years would it take you make the trip?

-

On 1 July 2018, Parent Ltd acquired all the shares of Son Ltd, on a cum-div. basis, for $2,057,000. At this date, the equity of Son Ltd consisted of: $ 1,000,000 Share capital 500 000 shares...

-

Are employer contributions into employees health savings accounts taxed as earnings of the employees?

-

Are employer contributions into employees health savings accounts taxed as earnings of the employees?

-

Commencing in June, Alan Oldt is eligible to receive monthly payments from a pension fund. What procedure should Oldt follow if he does not wish to have federal income taxes withheld from his...

-

Suggest factual, conceptual, procedural, and metacognitive statements for the following: I can process financial data for up to 10 million dollars in revenue sales; Well enough to effectively manage...

-

Which is an example of a debt danger sign? a. I list down all debts that I have on a notebook. b. I regularly check my credit report and report errors in it. c. I always max out my credit cards when...

-

When a corporation sells its assets on the installment method prior to making a liquidation distribution of the installment notes, a shareholder receiving installment notes in a liquidation: Question...

Study smarter with the SolutionInn App