Gainsborough Fashions Ltd operates a small chain of fashion shops. In recent months the business has been

Question:

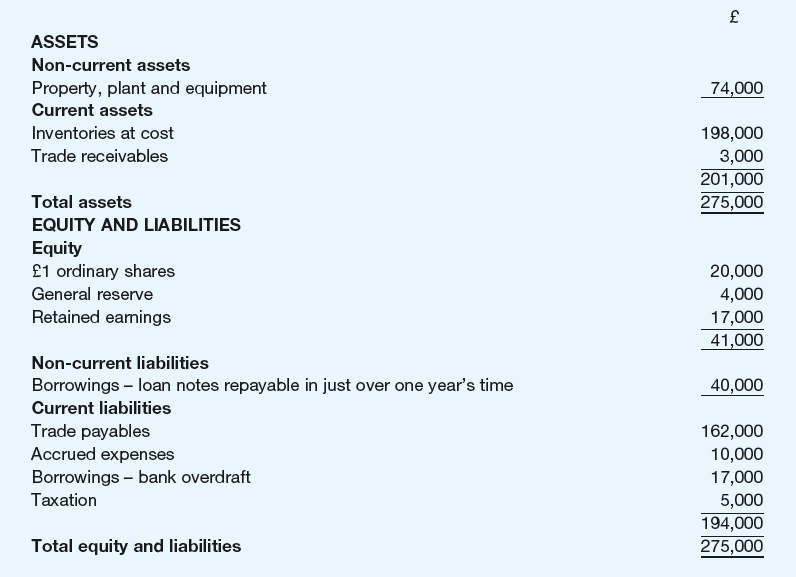

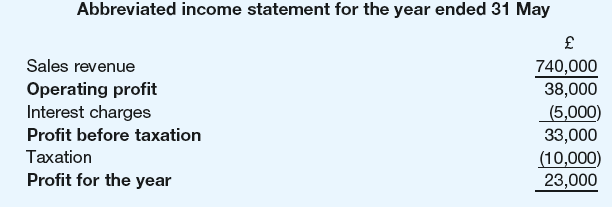

The most recent financial statements of the business are as follows:

A dividend of £23,000 was paid for the year.

Notes:

1 The loan notes are secured by personal guarantees from the directors.

2 The current overdraft bears an interest rate of 12 per cent a year.

Required:

(a) Identify and discuss the major factors that a bank would take into account before deciding whether to grant an increase in the overdraft of a business.

(b) State whether, in your opinion, the bank should grant the required increase in the overdraft for Gainsborough Fashions Ltd. You should provide reasoned arguments and supporting calculations where necessary.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney

Question Posted: