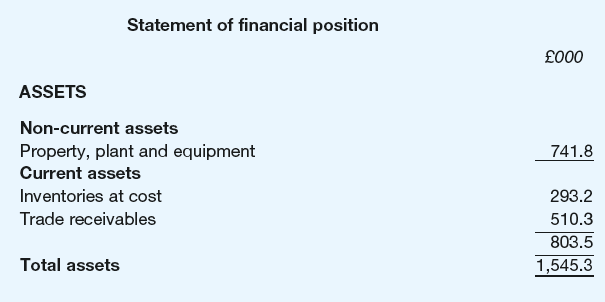

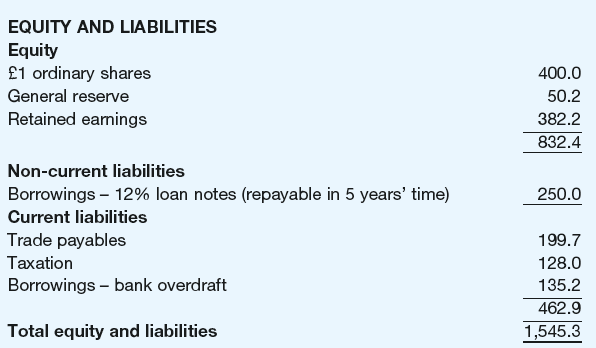

Russell Ltd installs and services heating and ventilation systems for commercial premises. The businesss most recent statement

Question:

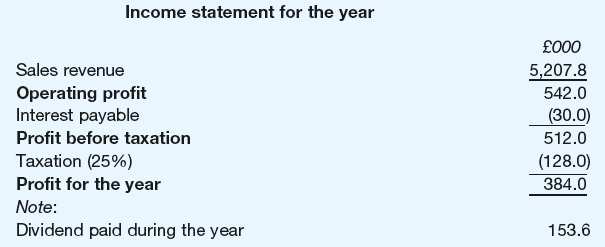

The business€™s most recent statement of financial position and income statement are as follows:

The business wishes to invest in more machinery and equipment to enable it to cope with an upsurge in demand for its services. An additional operating profit of £120,000 a year is expected if an investment of £600,000 is made in plant and machinery.

The directors are considering an offer from venture capitalists to finance the expansion programme.

The finance will be made available immediately through either

— an issue of £1 ordinary shares at a premium on nominal value of £3 a share; or

— an issue of £600,000 10 per cent loan notes at nominal value.

The directors wish to maintain the same dividend payout ratio in future years as in past years whichever method of finance is chosen.

Required:

(a) For each of the financing schemes:

1 prepare a projected income statement for next year;

2 calculate the projected earnings per share for next year;

3 calculate the projected level of gearing as at the end of next year.

(b) B riefly assess both of the financing schemes under consideration from the viewpoint of the existing shareholders.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney