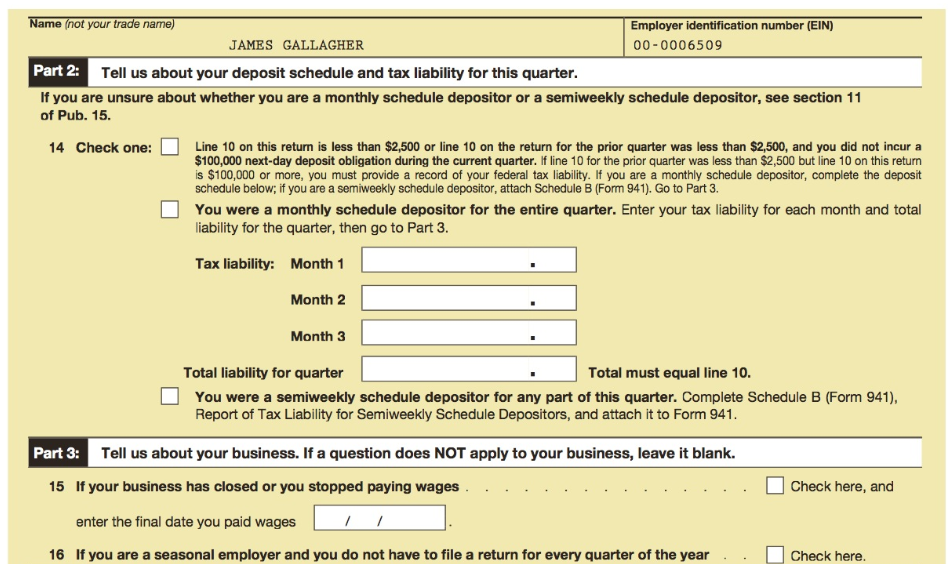

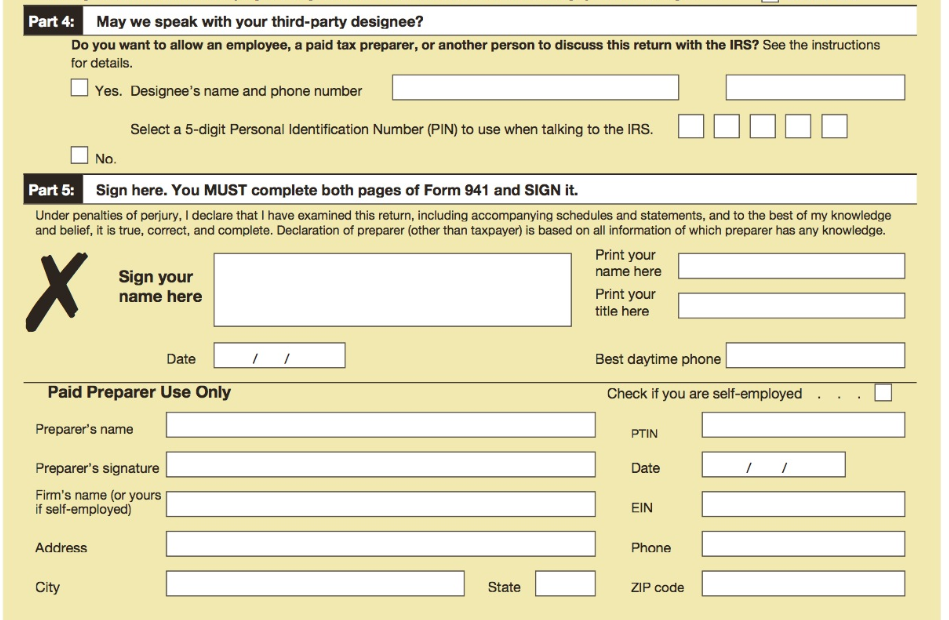

Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-57) for

Question:

July............ ....$7,891.75

August ...........7,984.90

September....7,989.27

State unemployment taxes are only paid to California. The company does not use a third-party designee, and the tax returns are signed by the president, James Gallagher (Phone: 916-555-9739).

Transcribed Image Text:

Name (not your trade name) Employer identification number (EIN) JAMES GALLAGHER 00-0006509 Part 2: Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. 15. Line 10 on this return is less than $2,500 or line 10 on the return for the prior quarter was less than $2,500, and you did not incur a $100,000 next-day deposit obligation during the current quarter. If line 10 for the prior quarter was less than $2,500 but line 10 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below; if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3. 14 Check one: You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3. Tax liability: Month 1 Month 2 Month 3 Total liability for quarter Total must equal line 10. You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Part 3: Tell us about your business. If a question does NOT apply to your business, leave it blank. 15 If your business has closed or you stopped paying wages Check here, and enter the final date you paid wages 16 If you are a seasonal employer and you do not have to file a return for every quarter of the year Check here. Part 4: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details. |Yes. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to the IRS. |No. Part 5: Sign here. You MUST complete both pages of Form 941 and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Print your name here Sign your name here Print your title here Date Best daytime phone Paid Preparer Use Only Check if you are self-employed Preparer's name PTIN Preparer's signature Date Firm's name (or yours if self-employed) EIN Address Phone City State ZIP code

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 69% (13 reviews)

Form 941 for 20 Employers QUARTERLY Federal Tax Return Rev January 2016 Department of the Treasury Internal Revenue Service 0 0 8 7 Employer identific...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Refer to Problem 3. After consulting with various fitness facilities in his state and examining demographic data, Miles was able to estimate the following demand probabilities: P (Low) = 0.2; P...

-

Refer to Problem 3-11A. Complete Parts 2, 4, and 5 of Form 941 for Cruz Company for the third quarter of 2016. Cruz Company is a monthly depositor with the following monthly tax liabilities for this...

-

Refer to Problem 3-11A. Complete Parts 2, 4, and 5 of Form 941 (on page 3-41) for Cruz Company for the third quarter of 2017. Cruz Company is a monthly depositor with the following monthly tax...

-

The following table describes a randomized trial comparing an experimental medication to a placebo for treatment of reflux. Experimental Treatment Placebo (n = 100) Patient Characteristics (n = 100)...

-

Desmond is 25 years old and he participates in his employer's 401(k) plan. During the year, he contributed $3,000 to his 401(k) account. What is Desmond's 2015 saver's credit in each of the following...

-

On January 10 Bette Eaton uses her Stage Co. credit card to purchase merchandise from Stage Co. for $1,400. On February 10 Eaton is billed for the amount due of $1,400. On February 12 Eaton pays...

-

House Handy Products manufactures plastic products and utensils for use in several situations. The company produces and sells a vast range of products that can be used in the home (plastic cooking...

-

The normal capacity of a manufacturing plant is 30,000 direct labor hours or 20,000 units per month. Standard fixed costs are $6,000, and variable costs are $12,000. Data for two months follow: For...

-

Suggest one best practice recommendation for backbone design and explain why it's a best practice.

-

The Planet Corporation produces a product that passes through two processes. During June, the first department 63,000 units to the second department. The cost of the units transferred was $94,500....

-

Gallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2017. Using the information presented below, complete Part 1 of Form 941, # of...

-

Stan Barker opened Quik-Stop Market on January 3, 2017. The business is subject to FICA taxes. At the end of the first quarter of 2017, Barker, as president of the company, must file Form 941,...

-

To view the flowchart shapes in Microsoft Excel, select the following options from the main menu: InsertShapes. There should be many of them (using Excel 2013). If you allow your mouse to hover over...

-

The Assembly Department of the Long - Distance Golf Club Super Driver Company, has the following production and cost data at the end of March, 2 0 2 1 . Production: 1 2 , 6 0 0 units started into...

-

On a horizontal table, puck A has an initial speed of 1.4 m/s heading south of east, making an angle of 35 with the horizontal, while puck B is heading north. After the collision, puck B is heading...

-

What are the six Vs of data? The process of data cleansing is what type of data analytics challenge? What is the main difference between qualitative and quantitative data? What is the...

-

What are some internal controls of student payments A / R ? what type of questionnaire do you ask of student payments accounts receivab the internal control questionnaire for student payments and...

-

Amount of invoice $ 6 4 0 terms 5 / 1 0 , n / 6 0 invoice date 7 / 9 actual partial payment made $ 4 4 0 date of partial payment 7 / 1 8 amount of payment to be credited? Balance outstanding?

-

In problem, find the slope and y-intercept of each line. Graph the line. y = -3x + 4

-

What are the two methods used to translate financial statements and how does the functional currency play a role in determining which method is used?

-

Carson Beck works at the local Worst Buy Shop. As a full-time student at the local university, he is being paid an hourly rate of $4.20 an hour. One week, Beck worked 37 hours. a. Beck's earnings for...

-

Under the decimal system of computing time worked at Timmerman Company, production workers who are tardy are "docked" according to the schedule shown below. Minutes Late in Ringing inFractional Hour...

-

Potts, Inc., recently converted from a 5-day, 40-hour workweek to a 4-day, 40-hour workweek, with overtime continuing to be paid at one and one-half times the regular hourly rate for all hours worked...

-

Mary would like to save $10,000 at the end of 5 years for a future down payment on a car. How much should she deposit at the end of each month in a savings account that pays 1.2%/a, compounded...

-

AA stock price is $45/share. The stock is expected to pay dividends $2.50 in the coming year. After reviewing all information, you concluded: the price one year from now will be $50/share and you...

-

Fung is planning for the correct after tax and after inflation real rate of return to use. If inflation will be 1.3%, the average rate of return on his investments will be 4.9%, and the tax rate on...

Study smarter with the SolutionInn App