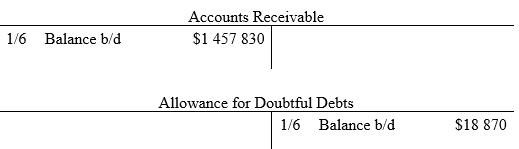

On 1 June, Sugar Rush Ltd had Accounts Receivable and Allowance for Doubtful Debts accounts as below.

Question:

On 1 June, Sugar Rush Ltd had Accounts Receivable and Allowance for Doubtful Debts accounts as below. GST Inclusive.

The following transactions occurred during the month of June:

5. Credit sales totalled \($2\) 050 620 (GST inclusive).

6. Sales returns amounted to \($41\) 349 (GST inclusive).

7. Cash collected from debtors totalled \($2\) 402 400.

8. Bad debts written off \($27\) 203 (GST inclusive).

Based on an ageing of accounts receivable on 30 June, the firm determined that the Allowance for Doubtful Debts account should have a credit balance of \($21\) 060 (GST exclusive) on the Statement of financial position as at 30 June.

Required:

(d) Prepare general journal entries to record the four transactions above and to adjust the Allowance for Doubtful Debts account to the required amount.

(e) Show how accounts receivable and the allowance for doubtful debts would appear on the Statement of financial position at 30 June.

(f) On 3 September, Flashy Fundraisers Ltd, whose \($4\) 120 (GST inclusive) account had been written off as uncollectable on 1 June, paid their account in full. Prepare journal entries to record the collection.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie