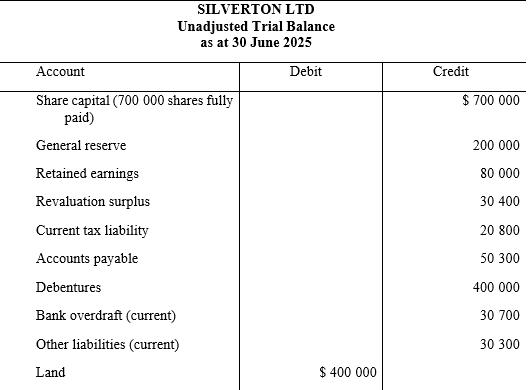

Silverton Ltd prepared the unadjusted trial balance as at 30 June 2025 shown below. The following information

Question:

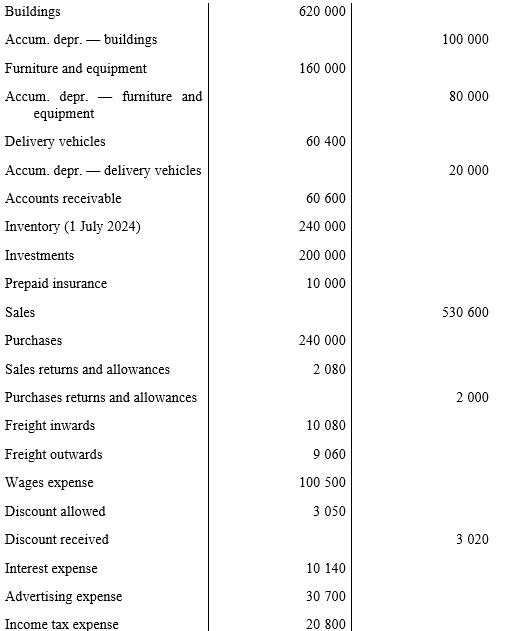

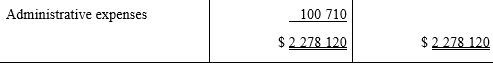

Silverton Ltd prepared the unadjusted trial balance as at 30 June 2025 shown below.

The following information and events are yet to be recorded by the company on 30 June 2025.

1. Inventory on hand after a physical stocktake at 30 June 2025 amounted to $265 000.

2. Prepaid insurance at the end of the year amounted to $3000.

3. Wages accrued and unpaid were $1700.

4. Interest owing and unrecorded on debentures and bank overdraft was $15 000.

5. Depreciation to be recorded on delivery vehicles at the rate of 20% p.a., on buildings at the rate of 5% p.a., and on furniture at the rate of 10% p.a. All these assets have been on hand throughout the year.

6. Interest due on investments amounted to $6000.

7. Sales made on the last day of the financial year but not recorded were for $8000.

8. The directors have decided to transfer $20 000 to the general reserve from retained earnings.

9. Dividends of 5c per share were recommended. An interim dividend of $35 000 had been paid during the year, and this dividend had been debited to the Retained Earnings account.

10. The company issued 30 000 bonus shares valued at $1 each out of the revaluation surplus.

Required

(a) Prepare the adjusting entries necessary.

(b) Prepare a detailed income statement for Silverton Ltd for the year ended 30 June 2025.

(c) Prepare the statement of changes in equity for Silverton Ltd for the year ended 30 June 2025.

(d) Prepare the balance sheet for Silverton Ltd as at 30 June 2025.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie