Baku Limited is a manufacturer of ladies' clothing. The following information has been extracted from the company's

Question:

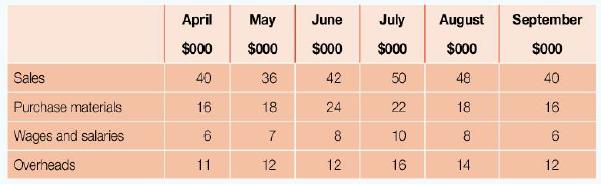

Baku Limited is a manufacturer of ladies' clothing. The following information has been extracted from the company's budgets for the six months ending 30 September 2015.

Additional information:

• All sales are on credit. Forty per cent of customers pay in the month of sale and receive 5 per cent settlement discount. Fifty per cent of customers pay in the month after sale, 5 per cent pay two months after sale and the remaining 5 per cent of sales become irrecoverable debts.

• Purchases of materials are all on credit and suppliers are paid in the month following sale.

One half of all suppliers allow Baku Limited to deduct a settlement discount of 2.5 per cent.

• Wages and salaries are paid in the month they are incurred.

• Overheads include $2000 per month depreciation. Of the remaining overheads, 40 per cent are variable and are paid the month after they are incurred. The remainder of overheads are fixed and these are paid in the month they are incurred.

• Taxation of $5000 is payable in August.

• The company plans to pay for additional non-current assets of $15 000 in July and $9000 in September.

• The bank has agreed to provide an overdraft facility to the company of $15 000.

• The bank balance at 1 April 2015 is expected to show an overdraft of $2100.

Required

a. Prepare cash budgets for each of the four months June-September 2015.

The directors of Baku Limited are aware that they may suffer a shortage of cash resources in the coming months.

b. Advise the directors of actions they could take to improve the cash position of the company over the four months of the cash budget prepared in part (a).

c. Explain two benefits to a business of preparing budgets.

d. Explain two drawbacks to a business of preparing budgets.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone