The following information is available about Gamble plc: In 2001 it issued at $0.75 a number

Question:

The following information is available about Gamble plc:

• In 2001 it issued at $0.75 a number of ordinary shares with a nominal value of $0.50 each.

• During 2007 Gamble Ltd issued $200,000 6 percent debentures repayable in 2018.

• On 1 January 2014 retained earnings were $62,000.

• On 31 December 2014 the non-current assets had a value of $610,000.

Further information relating to 2014 is as follows:

• Income gearing was 6.25 percent.

• The tax charge for the year was calculated as 20 percent of profit before tax.

• The ordinary dividends paid during the year were $54,000.

• Earnings per share were $0.22.

• Dividends per share were $0.09.

• The directors decided to create a general reserve of $30,000.

• The market value of the ordinary shares was $2.50.

Required

a. Starting with profit from operations, prepare a statement to calculate the retained profit for the year ended 31 December 2014.

b. Giving as much detail as possible, prepare the statement of financial position at 31 December 2014.

c. Calculate:

i. The dividend cover

ii. The price earnings ratio

iii. The dividend yield

iv. The gearing ratio

v. The return on capital employed.

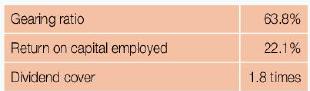

Vox plc is a company in the same line of business as Gamble plc and is in a similar location. The following ratios have been calculated for Vox plc.

Required

d. Compare and comment on the performance of Gamble plc and Vox plc in the light of these ratios.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone